How To Invest in Real Estate with a Self-Directed IRA Non-Recourse Loan

Key Points

- A non-recourse loan is a loan that is guaranteed by the Self-Directed IRA, and not by the IRA account holder.

- It is typically used in a Self-Directed IRA to help finance the acquisition of real estate.

- If a default occurs on the non-recourse loan, only the collateral itself can be foreclosed to satisfy the loan. There is no additional recourse against the IRA owner or other assets.

- The non-recourse lending program provides Self-Directed IRA account holders with expertise, unmatched customer service, and fixed rates so you can enjoy a seamless real estate investing experience.

During uncertain economic conditions, investors may turn to alternative assets to diversify their portfolios and receive more stable returns. The most popular alternative investment is real estate. However, some investors may shy away from real estate investing because they may believe it is too complicated or expensive. However, the savviest investors utilize a popular strategy to grow their Self-Directed IRA through real estate by leveraging a non-recourse loan.

Let’s explore what a non-recourse loan is, how it works, and the benefits it provides real estate IRA investors. It may just be the perfect opportunity for you to invest in the property of your dreams and achieve a richer retirement!

What is a Non-Recourse Loan?

A non-recourse loan is a loan that is guaranteed by the Self-Directed IRA, and not by the IRA account holder. It is typically used in a Self-Directed IRA to help finance the acquisition of real estate. Non-recourse loans benefit the borrower since, in the event of a default, only the collateral (typically a property) securing the loan is liable. The lender cannot go after other IRA assets or the IRA owner personally.

A non-recourse loan can be summed up as follows:

- The title of the property and the non-recourse loan is in the name of the Self-Directed IRA.

- A non-recourse lender issues a loan to your IRA.

- The non-recourse loan is secured only by the collateral (the property itself) and not by the IRA or the IRA account holder.

- If the IRA defaults on the loan payments, then the lender will foreclose and take the property back. You will only lose your collateral, not other IRA assets or funds.

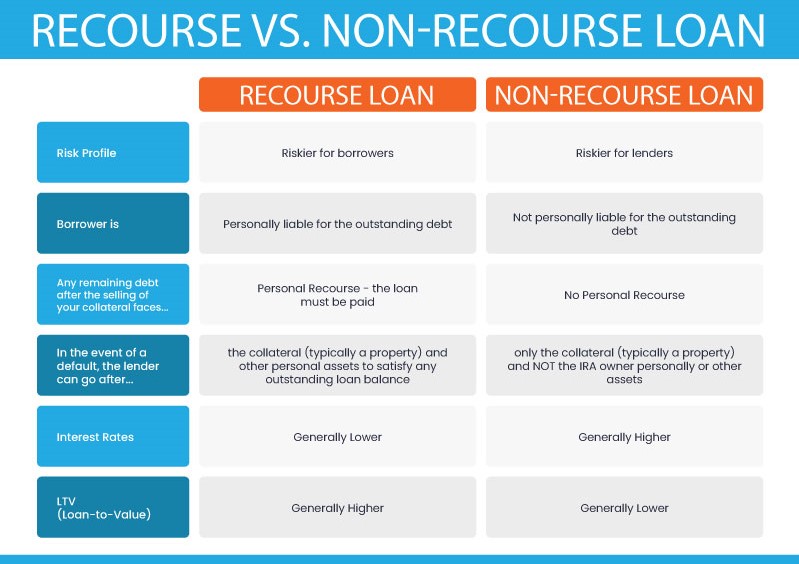

What is the Difference Between a Non-Recourse Loan and a Recourse Loan?

Recourse and non-recourse loans are forms of debt financing used to purchase assets. In both cases, the collateral specified in the Loan Agreement may be foreclosed. However, the difference between recourse and non-recourse loans occurs after the collateral is taken:

Recourse Loan – A recourse loan holds the borrower personally liable for the debt. This means that after the collateral is taken, the lender can go after wages or other assets to collect what is owed.

Automobile loans are often recourse loans. If the borrower defaults, then the lender can seize the car and other assets to recoup all the funds owed.

Non-Recourse Loan – A non-recourse loan does not require the borrower to personally guarantee the loan. This means that if the borrower does not repay the loan, the collateral is foreclosed but the lender is unable to take any further legal action against the IRA or IRA owner.

Benefits of a Non-Recourse Loan

- The opportunity to further diversify your retirement portfolio with real estate, which may provide steadier investment income.

- Your personal assets are not tied to the non-recourse loan. Even if you default on the loan, the lender can only foreclose the collateral, but cannot go after your other assets.

- Self-Directed IRAs are IRS-compliant and tax-advantaged accounts, allowing account holders to maximize their retirement savings by investing in real estate and almost any other alternative asset they choose.

Types of Property You Can Invest in with a Non-Recourse Loan

Commercial

Industrial

Residential

Multi-Family

Non-Recourse Lending Program

Our experience with Self-Directed IRAs and unmatched customer service paired with a 5-star non-recourse lender and fixed rates provide you with a seamless experience so you can start investing in the property of your dreams.

Lending Program Details:

- Loan Amounts: $100,000 - $499,999 (will consider larger requests)

- Term:

- Loan Term: 3 - 5 years

- Amortization: Up to 25 years

- Loan Rate: Prime +

- Loan-to-Value: 65% ±

- Fast Turnaround Time:

- Approval: Within 7 days

- Closing: 3 - 6 weeks from application to closing (determined by the title work)

- Low Fees:

- Origination Fee: 2%

- Estimated costs for title, filings, etc.: $2,500 - $5,000

- Debt Service Coverage Ratio: 1.25% +

Want to learn more about leveraging your real estate investment with a Self-Directed IRA?

How To Start Investing with a Non-Recourse Loan

Non-Recourse Loan Rules to Keep in Mind

Before utilizing a non-recourse loan, please keep in mind the following:

- The Self-Directed IRA owner cannot make the loan payments personally, which would qualify as a prohibited transaction. The loan must be paid by the IRA’s funds.

- Due to the lender’s risk associated with non-recourse loans, the loan may have stricter terms and higher interest rates depending on the agreed terms.

- Borrowers may be subject to Unrelated Debt Financed Income Tax (UDFI) on the income returned to the IRA as a result of the loan.

Do you have any questions about investing in real estate with a non-recourse loan? Schedule a free phone call with a Self-Directed IRA non-recourse expert to get your questions answered and get started investing in your desired property.

Disclaimer: All of the information contained on our website is a general discussion for informational purposes only. Madison Trust Company does not provide legal, tax, loan, or investment advice. Nothing of the foregoing, or of any other written, electronic, or oral statement or communication by Madison Trust Company or its representatives, is intended to be, or may be relied as, legal, tax, investment advice, statements, opinions, or predictions. Prior to making any investment decisions, please consult with the appropriate legal, tax, and investment professionals for advice.