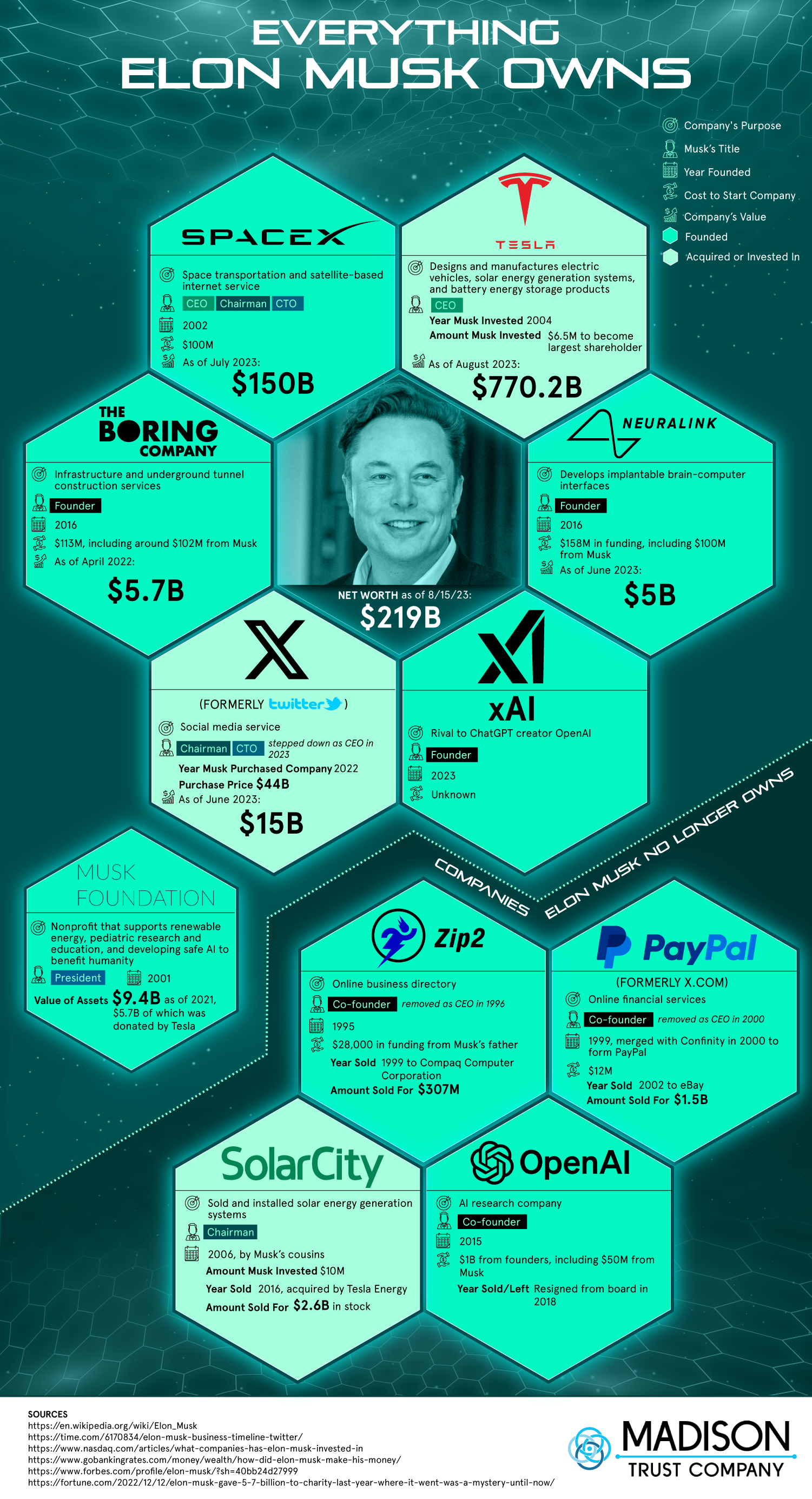

Elon Musk is the richest person in the world and has held this title off and on for the past few years. He has made his billions by founding or investing in a variety of forward-thinking tech companies. The most well-known Elon Musk companies are electric car company Tesla, space transportation and satellite company SpaceX, and, most recently, social media site Twitter, which he bought and rebranded as X. Elon Musk has founded a multitude of tech companies since the mid-1990s, some of which he sold to other corporations while others are still under his helm. The oldest company Elon Musk has retained is SpaceX, which he founded in 2002 for $100 million. More than two decades later, SpaceX is worth 1,500 times that initial investment with a whopping $150 billion value.

How many companies does Elon Musk own? Learn more with Madison Trust Company's visual below that explores everything Musk owns and used to own that has earned him the title of the world’s richest person.

What Companies Does Elon Musk Own?

Elon Musk owns six companies that span a range of industries, from electric vehicles to an underground tunnel company to the social media giant formerly known as Twitter. Elon Musk’s companies include SpaceX, Tesla, X (formerly Twitter), The Boring Company, Neuralink, and xAI. The newest Elon Musk company is xAI; it was formed in July 2023 as a rival to ChatGPT creator OpenAI. Musk was one of the original founders of OpenAI but resigned from the board in 2018. Most of the companies Elon Musk owns are worth billions of dollars; xAI’s value is unknown.

Companies Owned by Elon Musk and How Much They’re Worth

- Tesla: $770.2 billion as of August 2023

- SpaceX: $150 billion as of July 2023

- X (formerly Twitter): $15 billion as of June 2023

- The Boring Company: $5.7 billion as of April 2022

- Neuralink: $5 billion as of June 2023

- xAI: Unknown value

Which Companies Does Elon Musk No Longer Own?

Our compendium also includes everything Elon Musk owned that he no longer has any ownership of. Elon Musk’s first company was Zip2, an online business directory that he started with funding from his father and sold in 1999 for $307 million to Compaq Computer Corporation. With that money, he started an online financial service company called X.com, which merged with Confinity a year later to form PayPal. Two years later, PayPal was sold to eBay for $1.5 billion, which allowed Musk to found and invest in several of the companies he still has today. Musk invested in his cousins’ solar energy company, SolarCity, back in 2006; it was acquired by Tesla ten years later for $2.6 billion in stock. Elon Musk was also one the co-founders of OpenAI until his resignation from the board in 2018.

Companies Elon Musk No Longer Owns

- Zip2: Sold to Compaq Computer Corporation in 1999

- PayPal: Sold to eBay in 2022

- SolarCity: Acquired by Tesla in 2016

- OpenAI: Resigned from board in 2018

Do you hope to one day be as rich as Elon Musk? While his level of wealth may not be attainable, there are ways to invest your money now to be able to live a comfortable life during your retirement. Learn more about the different retirement investment options that are available, such as a Self-Directed IRA that allows you to invest in alternative assets or a Directed Trust to guarantee the safety and continuity of your family’s wealth.

The Complete List of Everything Elon Musk Owns

SpaceX

- Company’s Purpose: Space transportation and satellite-based Internet service

- Musk’s Title: CEO, chairman, CTO

- Year Founded: 2002

- Cost to Start Company: $100 million

- Company’s Value: $150 billion as of July 2023

Tesla

- Company’s Purpose: Designs and manufactures electric vehicles, solar energy generation systems, and battery energy storage products

- Musk’s Title: CEO

- Year Musk Invested: 2004

- Amount Musk Invested: $6.5 million to become largest shareholder

- Company’s Value: $770.2 billion as of August 2023

The Boring Company

- Company's Purpose: Infrastructure and underground tunnel construction services

- Musk’s Title: Founder

- Year Founded: 2016

- Cost to Start Company: $113 million, including around $102 million from Musk

- Company’s Value: $5.7 billion as of April 2022

Neuralink

- Company’s Purpose: Develops implantable brain-computer interfaces

- Musk’s Title: Founder

- Year Founded: 2016

- Cost to Start Company: $158 million in funding, including $100 million from Musk

- Company’s Value: $5 billion as of June 2023

X (Formerly Twitter)

- Company's Purpose: Social media service

- Musk’s Title: Chairman and CTO (stepped down as CEO in 2023)

- Year Musk Purchased Company: 2022

- Purchase Price: $44 billion

- Company’s Value: $15 billion as of June 2023

xAI

- Company's Purpose: Rival to ChatGPT creator OpenAI

- Musk’s Title: Founder

- Year Founded: 2023

- Cost to Start Company: Unknown

Musk Foundation

- Description: Nonprofit that supports renewable energy, pediatric research and education, and developing safe AI to benefit humanity

- Musk’s Title: President

- Year Founded: 2001

Value of Assets: $9.4 billion as of 2021, $5.7 billion of which was donated by Tesla

Companies Elon Musk No Longer Owns

Zip2

- Company's Purpose: Online business directory

- Musk’s Title: Co-founder, removed as CEO in 1996

- Year Founded: 1995

- Cost to Start Company: $28,000 in funding from Musk’s father

- Year Sold: 1999 to Compaq Computer Corporation

- Amount Sold For: $307 million

PayPal (formerly X.com)

- Company's Purpose: Online financial services

- Musk’s Title: Co-founder, removed as CEO in 2000

- Year Founded: 1999, merged with Confinity in 2000 to form PayPal

- Cost to Start Company: $12 million

- Year Sold: 2002 to eBay

- Amount Sold For: $1.5 billion

SolarCity

- Company's Purpose: Sold and installed solar energy generation systems

- Musk’s Title: Chairman

- Year Founded: 2006, by Musk’s cousins

- Amount Musk Invested: $10 million

- Year Sold: 2016, acquired by Tesla Energy

- Amount Sold For: $2.6 billion in stock

OpenAI

- Company's Purpose: AI research company

- Musk’s Title: Co-founder

- Year Founded: 2015

- Cost to Start Company: $1 billion from founders, including $50 million from Musk

- Year Sold/Left: Resigned from board in 2018

Would you like to display this on your website? Copy and paste the code below!

<center>

<textarea readonly>

<a href="https://www.madisontrust.com/information-center/everything-elon-musk-owns/">

<img src="https://www.madisontrust.com/wp-content/uploads/2023/09/everything-elon-musk-owns-3.png" alt="Everything Elon Musk Owns - MadisonTrust.com IRA - Infographic" title="Everything Elon Musk Owns - MadisonTrust.com - Infographic></a><br><a href="https://www.MadisonTrust.com" alt="MadisonTrust.com" title="MadisonTrust.com">By MadisonTrust.com</a>

</textarea>

</center>