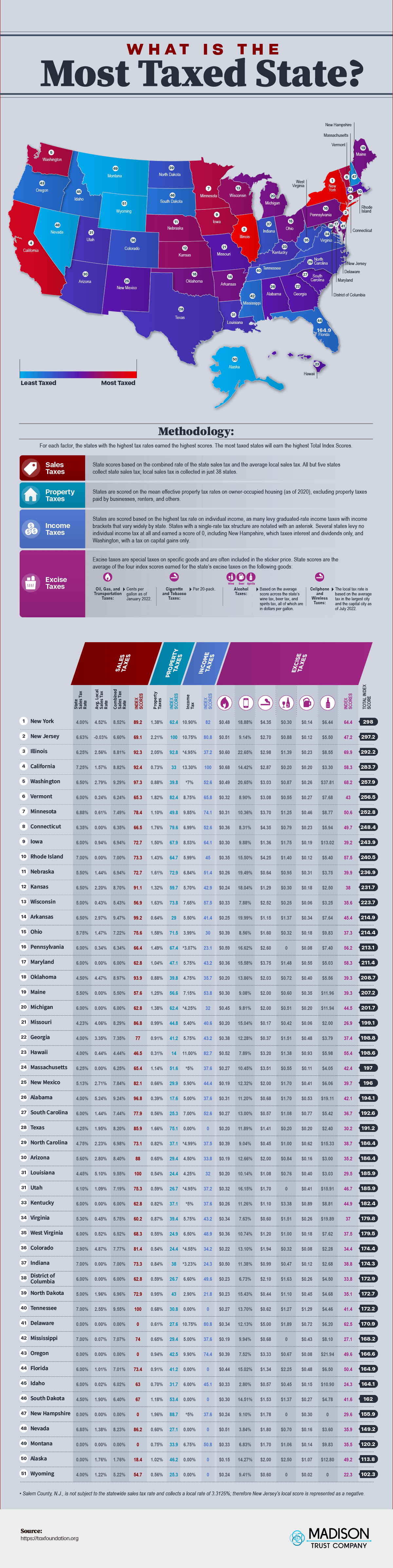

As Benjamin Franklin once said, “In this world, nothing is certain except death and taxes.” More than two hundred years later, it still rings true. While many Americans love to complain about the amount of taxes they are paying, taxes are necessary to maintain schools, roads, and so much more in society. But where are taxes in America the highest? The research team at Madison Trust Company sought to find the states with the highest taxes as well as the states with lowest taxes using data collected through TaxFoundation.org. They created a state tax comparison index that ranks all 50 states and Washington, D.C., on their state tax rates to determine the highest-taxed states. The taxes in this study include the three basic types of taxes: sales taxes, income taxes, and property taxes, as well as a breakdown of each state’s excise taxes, which are special taxes on specific goods often included in the sticker price. The study includes the state excise taxes each levies on goods like oil and gas, cigarettes, alcohol, and even cellphone bills. What is the highest-taxed state? Let’s just say New York isn’t called the “Vampire State” for nothing.

What State Has the Highest Taxes?

The state with the highest taxes is New York. New York is one of the states with highest income tax rates as well as high sales tax rates, high property taxes, and high excise taxes. The income tax in New York is the third-highest in the nation, up to 10.9% on individual income, although New York does levy graduated-rate income taxes that start at a lower rate of 4% and gradually increase as income level increases. New York residents earning an income of more than $25 million will be taxed at the highest rate of 10.9%, while middle-class residents of New York will be taxed at a rate of 5.85% to 6.25%. The state sales tax rate in New York is 4%, and the average local sales tax rate in the state is 4.52%, giving New York a combined state sales tax rate of 8.52%, the tenth highest sales tax in the U.S. Property taxes in New York are also on the higher end, with a mean effective property tax rate of 1.38% on owner-occupied housing. New York’s combined excise taxes were the third highest in the country, as the state charges a high cigarette tax, tax on oil and gas, and high cellphone and wireless taxes. One type of excise tax that New York did score low on, though, was alcohol taxes. The state earned some of the lowest scores for both their wine and beer taxes, and their taxes on spirits were also on the lower end.

The Top 10 States With the Highest Taxes

- New York

- New Jersey

- Illinois

- California

- Washington

- Vermont

- Minnesota

- Connecticut

- Iowa

- Rhode Island

What State Has the Highest Sales Tax?

California has the highest state sales tax, with a rate of 7.25%. Another four states were a close second with a 7% state sales tax: Indiana, Mississippi, Rhode Island, and Tennessee. Not all states collect state sales tax, though. The five no-sales-tax states are Alaska, Delaware, Montana, New Hampshire, and Oregon.

Local sales tax is collected in just 38 of the states. The state with the highest local sales tax is Alabama, with an average of 5.24%. Louisiana has the second-highest local sales tax, at 5.10%. Combined with its sales tax rate of 4.45%, Louisiana has the highest combined sales tax rate in the nation, at 9.55%.

The 5 States With the Highest Combined Sales Tax

- Louisiana: 9.55%

- Tennessee: 9.55%

- Arkansas: 9.47%

- Washington: 9.29%

- Alabama: 9.24%

What State Has the Highest Property Tax?

New Jersey has the highest state property taxes, with a rate of 2.21% of the value of the property. The study included the mean effective property tax rates on owner-occupied housing as of 2020, excluding property taxes paid by businesses, renters, and others. There are no states without property taxes, although some are much lower than others. Hawaii has the lowest property taxes, at 0.31%.

The 5 States With the Highest Property Tax Rates

- New Jersey: 2.21%

- Illinois: 2.05%

- New Hampshire: 1.96%

- Vermont: 1.82%

- Connecticut: 1.76%

What State Has the Highest Income Tax?

California has the highest state income tax, with a rate of up to 13.3%. California has graduated-rate income taxes that range from 1% to a 13.3% tax rate on income of more than $1 million. Middle-class Californians pay an income tax rate in the range of 6% to 9.3%. State income tax rates vary a lot, as each state’s income tax structure is different. A majority of the states have a graduated-rate income tax structure, while 11 states charge a flat income tax.

What States Have No Income Tax?

Seven states have no state income tax: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, and Wyoming. New Hampshire only taxes interest and dividends, while Washington only has a tax on capital gains.

The 5 States With the Highest Income Tax Rates

- California: 13.30%

- Hawaii: 11.00%

- New York: 10.90%

- District of Columbia: 10.75%

- New Jersey: 10.75%

Paying taxes is inevitable, even if you live in one of the states with the lowest taxes. In addition to the income, property, and sales taxes from your state, various types of investments can also be subject to taxes, although there are some investment strategies that you can implement to lessen the amount of taxes that you will owe. Read through our guide to tax-efficient investing to learn more about how you can receive an even bigger return on your investment by paying less in taxes.

Tax Rate Rankings, State by State

|

|

State |

State Sales Tax Rate |

Avg. Local Sales Tax Rate |

Combined Sales Tax Rate |

Sales Tax Index Score |

Property Taxes |

Property Taxes Index Score |

Income Tax |

Income Taxes Index Score |

Excise Tax: Oil, Gas, and Transportation Taxes (Cents per Gallon as of January 2022) |

Excise Tax: Cellphone and Wireless Taxes |

Excise Tax: Cigarette and Tobacco Taxes |

Excise Tax (Alcohol): Wine Tax |

Excise Tax (Alcohol): Beer Tax |

Excise Tax (Alcohol): Spirits Tax |

Excise Taxes Index Score |

TOTAL INDEX SCORE |

|

1 |

New York |

4.00% |

4.52% |

8.52% |

89.2 |

1.38% |

62.4 |

10.90% |

82.0 |

$0.482 |

18.88% |

$4.35 |

$0.30 |

$0.14 |

$6.44 |

64.4 |

298.0 |

|

2 |

New Jersey |

6.625% |

-0.03% |

6.60% |

69.1 |

2.21% |

100.0 |

10.75% |

80.8 |

$0.507 |

9.14% |

$2.70 |

$0.88 |

$0.12 |

$5.50 |

47.2 |

297.2 |

|

3 |

Illinois |

6.25% |

2.56% |

8.81% |

92.3 |

2.05% |

92.8 |

*4.95% |

37.2 |

$0.596 |

22.65% |

$2.98 |

$1.39 |

$0.23 |

$8.55 |

69.9 |

292.2 |

|

4 |

California |

7.25% |

1.57% |

8.82% |

92.4 |

0.73% |

33.0 |

13.30% |

100.0 |

$0.682 |

14.42% |

$2.87 |

$0.20 |

$0.20 |

$3.30 |

58.3 |

283.7 |

|

5 |

Washington |

6.50% |

2.79% |

9.29% |

97.3 |

0.88% |

39.8 |

*7% |

52.6 |

$0.49 |

20.65% |

$3.03 |

$0.87 |

$0.26 |

$37.81 |

68.2 |

257.9 |

|

6 |

Vermont |

6.00% |

0.24% |

6.24% |

65.3 |

1.82% |

82.4 |

8.75% |

65.8 |

$0.321 |

8.90% |

$3.08 |

$0.55 |

$0.27 |

$7.68 |

43.0 |

256.5 |

|

7 |

Minnesota |

6.875% |

0.61% |

7.49% |

78.4 |

1.10% |

49.8 |

9.85% |

74.1 |

$0.306 |

10.36% |

$3.70 |

$1.25 |

$0.46 |

$8.77 |

50.6 |

252.8 |

|

8 |

Connecticut |

6.35% |

0.00% |

6.35% |

66.5 |

1.76% |

79.6 |

6.99% |

52.6 |

$0.358 |

8.31% |

$4.35 |

$0.79 |

$0.23 |

$5.94 |

49.7 |

248.4 |

|

9 |

Iowa |

6.00% |

0.94% |

6.94% |

72.7 |

1.50% |

67.9 |

8.53% |

64.1 |

$0.30 |

9.88% |

$1.36 |

$1.75 |

$0.19 |

$13.02 |

39.2 |

243.9 |

|

10 |

Rhode Island |

7.00% |

0.00% |

7.00% |

73.3 |

1.43% |

64.7 |

5.99% |

45.0 |

$0.35 |

15.50% |

$4.25 |

$1.40 |

$0.12 |

$5.40 |

57.5 |

240.5 |

|

11 |

Nebraska |

5.50% |

1.44% |

6.94% |

72.7 |

1.61% |

72.9 |

6.84% |

51.4 |

$0.257 |

19.49% |

$0.64 |

$0.95 |

$0.31 |

$3.75 |

39.9 |

236.9 |

|

12 |

Kansas |

6.50% |

2.20% |

8.70% |

91.1 |

1.32% |

59.7 |

5.70% |

42.9 |

$0.240 |

18.04% |

$1.29 |

$0.30 |

$0.18 |

$2.50 |

38.0 |

231.7 |

|

13 |

Wisconsin |

5.00% |

0.43% |

5.43% |

56.9 |

1.63% |

73.8 |

7.65% |

57.5 |

$0.329 |

7.88% |

$2.52 |

$0.25 |

$0.06 |

$3.25 |

35.6 |

223.7 |

|

14 |

Arkansas |

6.50% |

2.97% |

9.47% |

99.2 |

0.64% |

29.0 |

5.50% |

41.4 |

$0.248 |

19.99% |

$1.15 |

$1.37 |

$0.34 |

$7.64 |

45.4 |

214.9 |

|

15 |

Ohio |

5.75% |

1.47% |

7.22% |

75.6 |

1.58% |

71.5 |

3.99% |

30.0 |

$0.385 |

8.56% |

$1.60 |

$0.32 |

$0.18 |

$9.83 |

37.3 |

214.4 |

|

16 |

Pennsylvania |

6.00% |

0.34% |

6.34% |

66.4 |

1.49% |

67.4 |

*3.07% |

23.1 |

$0.587 |

16.62% |

$2.60 |

0 |

$0.08 |

$7.40 |

56.2 |

213.1 |

|

17 |

Maryland |

6.00% |

0.00% |

6.00% |

62.8 |

1.04% |

47.1 |

5.75% |

43.2 |

$0.361 |

15.58% |

$3.75 |

$1.48 |

$0.55 |

$5.03 |

58.3 |

211.4 |

|

18 |

Oklahoma |

4.50% |

4.47% |

8.97% |

93.9 |

0.88% |

39.8 |

4.75% |

35.7 |

$0.20 |

13.86% |

$2.03 |

$0.72 |

$0.40 |

$5.56 |

39.3 |

208.7 |

|

19 |

Maine |

5.50% |

0.00% |

5.50% |

57.6 |

1.25% |

56.6 |

7.15% |

53.8 |

$0.30 |

9.08% |

$2.00 |

$0.60 |

$0.35 |

$11.96 |

39.3 |

207.2 |

|

20 |

Michigan |

6.00% |

0.00% |

6.00% |

62.8 |

1.38% |

62.4 |

*4.25% |

32.0 |

$0.452 |

9.81% |

$2.00 |

$0.51 |

$0.20 |

$11.94 |

44.5 |

201.7 |

|

21 |

Missouri |

4.225% |

4.06% |

8.29% |

86.8 |

0.99% |

44.8 |

5.40% |

40.6 |

$0.199 |

15.04% |

$0.17 |

$0.42 |

$0.06 |

$2.00 |

26.9 |

199.1 |

|

22 |

Georgia |

4.00% |

3.35% |

7.35% |

77.0 |

0.91% |

41.2 |

5.75% |

43.2 |

$0.376 |

12.28% |

$0.37 |

$1.51 |

$0.48 |

$3.79 |

37.4 |

198.8 |

|

23 |

Hawaii |

4.00% |

0.44% |

4.44% |

46.5 |

0.31% |

14.0 |

11.00% |

82.7 |

$0.517 |

7.89% |

$3.20 |

$1.38 |

$0.93 |

$5.98 |

55.4 |

198.6 |

|

24 |

Massachusetts |

6.25% |

0.00% |

6.25% |

65.4 |

1.14% |

51.6 |

*5% |

37.6 |

$0.265 |

10.45% |

$3.51 |

$0.55 |

$0.11 |

$4.05 |

42.4 |

197.0 |

|

25 |

New Mexico |

5.125% |

2.71% |

7.84% |

82.1 |

0.66% |

29.9 |

5.90% |

44.4 |

$0.189 |

12.32% |

$2.00 |

$1.70 |

$0.41 |

$6.06 |

39.7 |

196.0 |

|

26 |

Alabama |

4.00% |

5.24% |

9.24% |

96.8 |

0.39% |

17.6 |

5.00% |

37.6 |

$0.313 |

11.20% |

$0.68 |

$1.70 |

$0.53 |

$19.11 |

42.1 |

194.1 |

|

27 |

South Carolina |

6.00% |

1.44% |

7.44% |

77.9 |

0.56% |

25.3 |

7.00% |

52.6 |

$0.268 |

13.00% |

$0.57 |

$1.08 |

$0.77 |

$5.42 |

36.7 |

192.6 |

|

28 |

Texas |

6.25% |

1.95% |

8.20% |

85.9 |

1.66% |

75.1 |

0.00% |

0.0 |

$0.20 |

11.89% |

$1.41 |

$0.20 |

$0.20 |

$2.40 |

30.2 |

191.2 |

|

29 |

North Carolina |

4.75% |

2.23% |

6.98% |

73.1 |

0.82% |

37.1 |

*4.99% |

37.5 |

$0.388 |

9.04% |

$0.45 |

$1.00 |

$0.62 |

$15.33 |

38.7 |

186.4 |

|

30 |

Arizona |

5.60% |

2.80% |

8.40% |

88.0 |

0.65% |

29.4 |

4.50% |

33.8 |

$0.19 |

12.66% |

$2.00 |

$0.84 |

$0.16 |

$3.00 |

35.2 |

186.4 |

|

31 |

Louisiana |

4.45% |

5.10% |

9.55% |

100.0 |

0.54% |

24.4 |

4.25% |

32.0 |

$0.200 |

10.14% |

$1.08 |

$0.76 |

$0.40 |

$3.03 |

29.5 |

185.9 |

|

31 |

Utah |

6.10% |

1.09% |

7.19% |

75.3 |

0.59% |

26.7 |

*4.95% |

37.2 |

$0.319 |

16.15% |

$1.70 |

0 |

$0.41 |

$15.91 |

46.7 |

185.9 |

|

33 |

Kentucky |

6.00% |

0.00% |

6.00% |

62.8 |

0.82% |

37.1 |

*5% |

37.6 |

$0.26 |

11.26% |

$1.10 |

$3.38 |

$0.89 |

$8.81 |

44.9 |

182.4 |

|

34 |

Virginia |

5.30% |

0.45% |

5.75% |

60.2 |

0.87% |

39.4 |

5.75% |

43.2 |

$0.344 |

7.63% |

$0.60 |

$1.51 |

$0.26 |

$19.89 |

37.0 |

179.8 |

|

35 |

West Virginia |

6.00% |

0.52% |

6.52% |

68.3 |

0.55% |

24.9 |

6.50% |

48.9 |

$0.357 |

10.74% |

$1.20 |

$1.00 |

$0.18 |

$7.62 |

37.5 |

179.5 |

|

36 |

Colorado |

2.90% |

4.87% |

7.77% |

81.4 |

0.54% |

24.4 |

*4.55% |

34.2 |

$0.22 |

13.10% |

$1.94 |

$0.32 |

$0.08 |

$2.28 |

34.4 |

174.4 |

|

37 |

Indiana |

7.00% |

0.00% |

7.00% |

73.3 |

0.84% |

38.0 |

*3.23% |

24.3 |

$0.498 |

11.38% |

$0.99 |

$0.47 |

$0.12 |

$2.68 |

38.8 |

174.3 |

|

38 |

District of Columbia |

6.00% |

0.00% |

6.000% |

62.8 |

0.59% |

26.7 |

6.60% |

49.6 |

$0.23 |

6.73% |

$2.10 |

$1.63 |

$0.26 |

$4.50 |

33.8 |

172.9 |

|

39 |

North Dakota |

5.00% |

1.96% |

6.96% |

72.9 |

0.95% |

43.0 |

2.90% |

21.8 |

$0.23 |

15.43% |

$0.44 |

$1.10 |

$0.45 |

$4.68 |

35.1 |

172.7 |

|

40 |

Tennessee |

7.00% |

2.55% |

9.55% |

100.0 |

0.68% |

30.8 |

0.00% |

0.0 |

$0.274 |

13.70% |

$0.62 |

$1.27 |

$1.29 |

$4.46 |

41.4 |

172.2 |

|

41 |

Delaware |

0.00% |

0.00% |

0.00% |

0.0 |

0.61% |

27.6 |

10.75% |

80.8 |

$0.338 |

12.13% |

$5.00 |

$1.89 |

$0.72 |

$6.20 |

62.5 |

170.9 |

|

42 |

Mississippi |

7.00% |

0.07% |

7.07% |

74.0 |

0.65% |

29.4 |

5.00% |

37.6 |

$0.188 |

9.94% |

$0.68 |

0 |

$0.43 |

$8.10 |

27.1 |

168.2 |

|

43 |

Oregon |

0.00% |

0.00% |

0.00% |

0.0 |

0.94% |

42.5 |

9.90% |

74.4 |

$0.388 |

7.52% |

$3.33 |

$0.67 |

$0.08 |

$21.94 |

49.6 |

166.6 |

|

44 |

Florida |

6.00% |

1.01% |

7.01% |

73.4 |

0.91% |

41.2 |

0.00% |

0.0 |

$0.436 |

15.02% |

$1.34 |

$2.25 |

$0.48 |

$6.50 |

50.4 |

164.9 |

|

45 |

Idaho |

6.00% |

0.02% |

6.02% |

63.0 |

0.70% |

31.7 |

6.00% |

45.1 |

$0.33 |

2.80% |

$0.57 |

$0.45 |

$0.15 |

$10.90 |

24.3 |

164.1 |

|

46 |

South Dakota |

4.50% |

1.90% |

6.40% |

67.0 |

1.18% |

53.4 |

0.00% |

0.0 |

$0.30 |

14.51% |

$1.53 |

$1.37 |

$0.27 |

$4.78 |

41.6 |

162.0 |

|

47 |

New Hampshire |

0.00% |

0.00% |

0.00% |

0.0 |

1.96% |

88.7 |

*5% |

37.6 |

$0.238 |

9.10% |

$1.78 |

0 |

$0.30 |

0 |

29.6 |

155.9 |

|

48 |

Nevada |

6.85% |

1.38% |

8.23% |

86.2 |

0.60% |

27.1 |

0.00% |

0.0 |

$0.505 |

3.84% |

$1.80 |

$0.70 |

$0.16 |

$3.60 |

35.9 |

149.2 |

|

49 |

Montana |

0.00% |

0.00% |

0.00% |

0.0 |

0.75% |

33.9 |

6.75% |

50.8 |

$0.333 |

6.83% |

$1.70 |

$1.06 |

$0.14 |

$9.83 |

35.5 |

120.2 |

|

50 |

Alaska |

0.00% |

1.76% |

1.76% |

18.4 |

1.02% |

46.2 |

0.00% |

0.0 |

$0.151 |

14.27% |

$2.00 |

$2.50 |

$1.07 |

$12.80 |

49.2 |

113.8 |

|

51 |

Wyoming |

4.00% |

1.22% |

5.22% |

54.7 |

0.56% |

25.3 |

0.00% |

0.0 |

$0.24 |

9.41% |

$0.60 |

0 |

$0.02 |

0 |

22.3 |

102.3 |

Scoring Methodology

For each factor, the states with the highest tax rates earned the highest scores. The most taxed states earn the highest total index scores.

Sales Tax - State scores based on the combined rate of the state sales tax and the average local sales tax. All but five states collect state sales tax; local sales tax is collected in just 38 states.

Property Tax - States are scored on the mean effective property tax rates on owner-occupied housing (as of 2020), excluding property taxes paid by businesses, renters, and others.

Income Tax - States are scored based on the highest tax rate on individual income, as many levy graduated-rate income taxes with income brackets that vary widely by state. States with a single-rate tax structure are notated with an asterisk. Several states levy no individual income tax at all and earned a score of 0, including New Hampshire, which taxes interest and dividends only, and Washington, with a tax on capital gains only.

Excise Tax - Excise taxes are special taxes on specific goods and are often included in the sticker price. State scores are the average of the four index scores earned for the state’s excise taxes on the following goods:

- Oil, Gas, and Transportation Taxes: Cents per gallon as of January 2022

- Cigarette and Tobacco Taxes: Per 20-pack

- Alcohol Taxes: Based on the average score across the state’s wine tax, beer tax, and spirits tax, all of which are in dollars per gallon

- Cellphone and Wireless Taxes: The local tax rate is based on the average tax in the largest city and the capital city as of July 2022.

Would you like to display this on your website? Copy and paste the code below!

<center>

<textarea readonly>

<a href="https://www.madisontrust.com/information-center/what-is-the-most-taxed-state/">

<img src="https://www.madisontrust.com/wp-content/uploads/2023/02/most-taxed-state-5.png" alt="What Is the Most Taxed State? - MadisonTrust.com IRA - Infographic" title="What Is the Most Taxed State? - MadisonTrust.com - Infographic></a><br><a href="https://www.MadisonTrust.com" alt="MadisonTrust.com" title="MadisonTrust.com">By MadisonTrust.com</a>

</textarea>

</center>