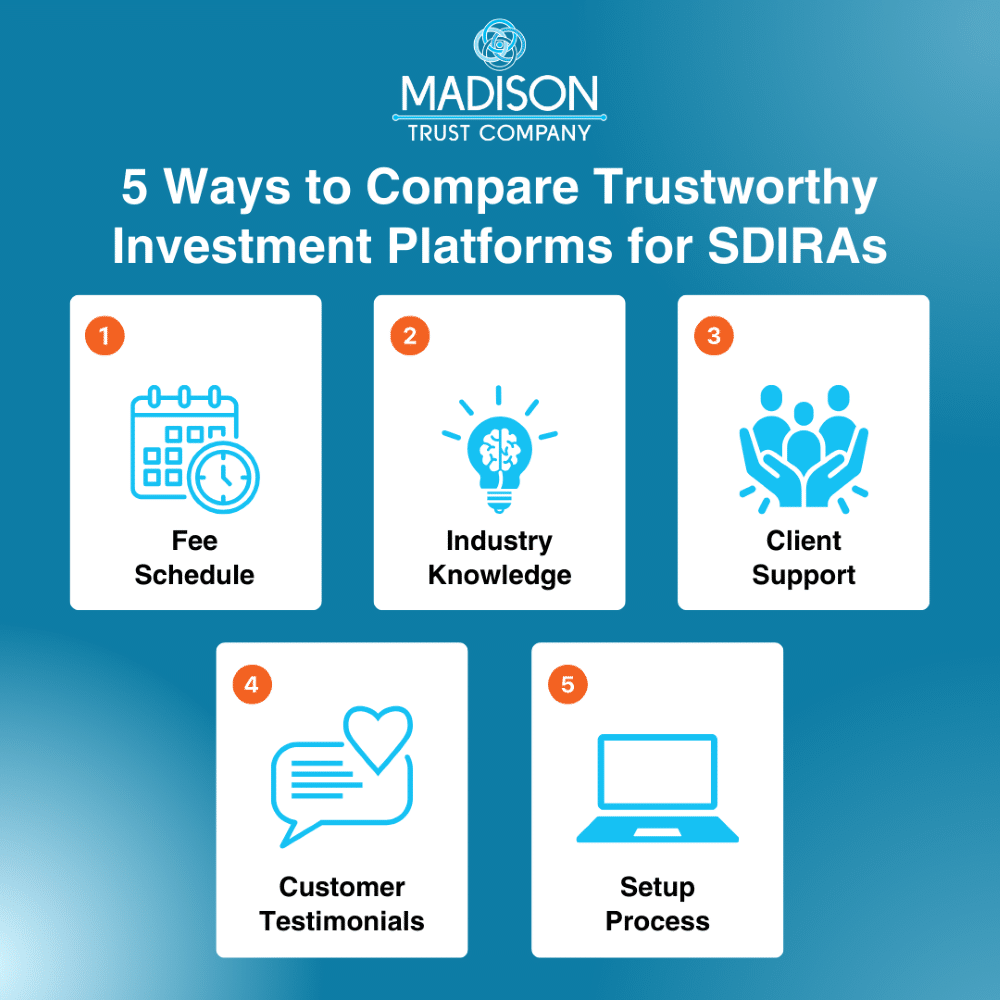

5 Ways to Compare Trustworthy Investment Platforms for SDIRAs

Written By: Daniel Gleich

Key Points

- You can grow your retirement savings through a variety of alternative assets with a Self-Directed IRA (SDIRA).

- There are many SDIRA platforms out there so it’s seen as best practice to shop around and explore all your options.

- As you compare SDIRA companies, consider factors such as fees, industry knowledge, client support, reviews, and the setup process.

If you're looking to expand your retirement investing beyond Wall Street products, a Self-Directed IRA (SDIRA) should be on your radar. With an SDIRA, you can invest in a variety of alternative assets, such as real estate, precious metals, startups, private businesses, and more.

While it may be tempting to choose the first SDIRA platform you find, it’s in your best interest to shop around and compare your options. This way, you can zero in on the ideal SDIRA company for your unique needs and preferences. Here are some factors to consider:

What is a Self-Directed IRA?

First and foremost, let’s dive deeper into what an SDIRA actually is and how it works. An SDIRA is a lot like a Traditional IRA. It’s a tax-advantaged retirement savings tool that allows you to contribute funds and grow them through investments. The difference between a Traditional IRA and an SDIRA, however, is in the types of investments you can make.

With a Traditional IRA, you generally invest in stocks, bonds, and mutual funds. An SDIRA offers far more flexibility in that you can invest in a plethora of alternative assets you’re either very familiar with or simply passionate about, such as real estate, precious metals, promissory notes, and private placements. You don’t have to restrict yourself to Wall Street investments.

Factors to Consider When Looking for a Self-Directed IRA

As you shop around, you’ll find there are a number of SDIRA platforms on the market. While they all open the doors to alternative investing, there are noteworthy differences between them. That’s why it’s well worth your time to compare the following factors when searching for the right SDIRA for your particular situation.

1. Fees

Every SDIRA company has its own fee structure. Oftentimes, they charge asset-based holding fees that will increase as your investments grow. These fees are charged at a percentage based on your account's value. Some platforms also sneak in hidden fees, which can diminish your returns. At Madison Trust, we’re proud to offer a flat-rate fee structure, meaning you’ll pay a set price, regardless of your account’s value.

2. Industry Knowledge

The best SDIRA platforms will come with Self-Directed IRA Specialists who have a deep understanding of various alternative assets, like real estate and precious metals. They can provide you with the information about self-direction that you need to make the most informed decisions. Fortunately, the SDIRA specialists at Madison Trust complete rigorous CISP training and can do just that.

3. Client Support

At some point in time, you may have questions or require assistance with your SDIRA. This may be particularly true if you’re new to this type of retirement account. With a reputable, client-first SDIRA Company, you should receive timely customer support. Madison Trust genuinely cares about your success and is always here for you with free, live guidance.

4. Customer Reviews

One area to consider researching when looking into an SDIRA custodian is their customer reviews. Positive reviews from current and former account holders are far more telling. Before you commit to an SDIRA platform, read reviews on reputable websites so you can get an idea of their reputation in the industry. Over the years, Madison Trust has grown to 20,000+ satisfied clients with over 2,000+ 5-star reviews.

5. Setup Process

The sooner you start saving for retirement with an SDIRA, the better. Pay attention to the setup process of any company that piques your interest. You should be able to open an SDIRA quickly, without the hassle. At Madison Trust, all you have to do is complete our easy online application, transfer or roll over funds from an existing retirement account, and instruct Madison Trust to issue a check or wire to the investment of your choice.

Start Your Self-Directed IRA Journey Today

For more information about investing in alternative assets through a Self-Directed IRA, schedule a discovery call with Madison Trust. We look forward to hearing from you!