7 Fun Ways the Entire Family Can Save

Written By: Daniel Gleich

Key Points

- There are many fun ways the entire family can save such as shopping together, creating a visual goal, and making it a fun game.

- Saving early and often will give you a head start to meet your financial goals and learn valuable life skills.

- Madison Trust can answer your questions about saving in a Self-Directed IRA (SDIRA).

Life can be expensive. Groceries, housing, education, cars, vacations, retirement, and more take up a hefty chunk of our budget. One of the most useful life skills is knowing when to save vs. spend. Plus, the earlier in life you learn this skill, the better.

Consider how teaching your kids about personal finance can set them up for success. Upkeeping finances as a family can be fun, as you work together to reach joint goals and create irreplaceable memories.

Here are a few fun ways the entire family can save:

1. Shop and Cook Together

One fun way to teach children the value of money can start with their favorite foods. Ask them what they would like to eat for dinner this week. Then, look at the coupon circular for discounts at your local grocery store, go shopping, cook, and eat together. Preparing meals and eating as a family not only helps with financial know-how, but also enhances communication between children and parents, and is said to improve academic performance and self-esteem.

Another fun idea is to grow a family garden. This can teach children where their food comes from (not the store!), responsibility, patience, and how to reap what they sow. Plus, you’ll be saving on the high costs of fruits and vegetables.

2. Create a Visual Goal

As schedules fill up with school, band camp, and baseball games, you may get sidetracked from upkeeping your family’s financial goals. Consider creating a colorful, tangible visual aid to serve as a reminder.

For example, let’s say your family wants to save $800 for a family trip to the local theme park. Consider designing a poster with an image of a thermometer or a ladder that you can color in as your family increases your savings toward this goal.

For a more classic approach, have your children keep track of their change in a piggy bank. Or, it can be as simple as labeling three envelopes as “save,” “spend,” and “donate” and having your children select which one to add their money to.

3. Make Learning Finance a Game

Make saving fun by creating a game! You can track who can save the most this month or who can come up with the most money-saving tactics.

You can even turn your next family game night into a friendly competition. Have the winner of the board or video game select someone to contribute a small amount (amount dependent on their overall earnings) towards an activity that you will do as a family such as go to the movies or dine out.

4. Match Your Child's Savings

It can be challenging for kids to not spend their holiday or birthday gift money on the first toy they see. To combat this spending, consider offering an incentive to save it instead.

One idea is to match dollar for dollar, so they are encouraged to save their gifts for something they truly desire. This teaches children the value of money and how to prioritize wants and needs. You may be surprised that they choose to contribute to family goals instead of spending it immediately.

5. Open a Retirement Account Like a Self-Directed Roth IRA

As your child grows up, they may start to earn income from babysitting, lawn mowing, working for your family business, etc. They can use these earnings to contribute to a retirement account.

Consider opening a Self-Directed Roth IRA in your child’s name. In a Self-Directed Roth IRA, funds grow tax-free. They will take advantage of compound interest and get a head start on their retirement savings.

Even if they don’t personally contribute the funds, you can do so if it's not over the amount they have earned. For example, if they earn $500 mowing lawns, anyone could contribute $500 to their Roth IRA.

6. Host a Garage Sale

To generate extra cash, consider organizing a garage sale to sell old clothes, toys, and other items no longer needed. If products are not sold, consider asking your kids if they will donate the rest to give back to the community.

7. Check Financial Spending and Saving Habits

Take time each month to gather around the table and look at your family’s spending habits and decide where you can save.

Here are a few discussion topics:

- Are there any subscriptions that are not used frequently?

- Can you create your favorite restaurant meal at home?

- Can you use less water while brushing your teeth or showering?

- Can the kids ride their bike to their friend’s house down the block?

- Can you set up a carpool with other parents to school or various activities?

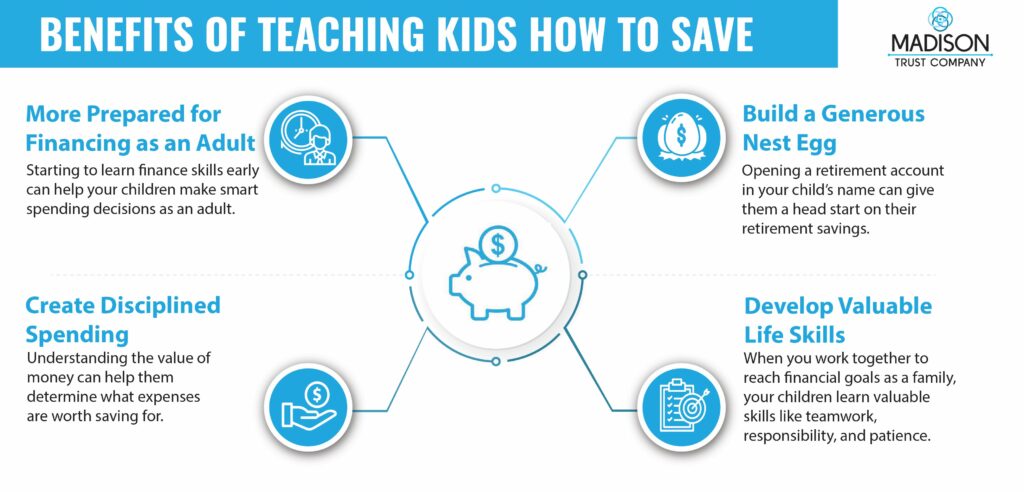

What Are The Benefits of Teaching My Family How To Save?

Conclusion: Let's Tie It All Up

Although learning finance may not seem like the most fun activity to many, it is important to do so at all ages. There are many fun ways to learn about finance and doing so as a family can be beneficial in the long run.

Are you interested in learning more? Schedule a call with a Self-Directed IRA Specialist today.