Atomic No. 47: Invest in Silver with a Gold IRA

Written By: Daniel Gleich

Key Points

- A Self-Directed IRA (SDIRA) grants the ability to invest in alternative assets like silver through its parallel tool, the Precious Metals IRA, supplementally known as a Gold IRA.

- The uses for silver are copious, including medicine, electronics, jewelry, water purification, automobiles, and more. It’s presumable that silver will potentially retain value as it’s tangible and aids in an excess of functions.

- The minimum purity allowed by the IRS for an investment in silver is 99.9%. This silver investment typically comes in the form of coins and bars.

While gold has generally been a highlighted form of currency for centuries, silver supplies prodigious opportunities to those looking to invest in precious metals. Countless industries utilize silver in their products and processes. Because of this, there is potential that it could never depreciate to zero. Silver may be an excellent contributor to your retirement savings through the vehicle of a Self-Directed IRA also known as a Precious Metals IRA/Gold IRA.

There’s much to digest about this member of the periodic table of elements. Here’s the basics of investing in silver with a Gold IRA.

A Noble Earth Metal That’s Never Idle

Silver has been seen as incredibly versatile through its plentiful endeavors. Some of these even involve life-aiding initiatives, which only doubles its benefits for your Precious Metals IRA. Besides developing beautiful jewelry, silver can effectively kill bacteria as an antimicrobial agent and is prevalent in items such as bandages. It’s used in surgical instruments like scalpels, and part of essential machines such as pacemakers and electrocardiograms.

Dentists work with silver regularly as it’s a component of dental fillings. It’s also used in food packaging to help keep food fresh and safe for consumption. Silver helps purify water as part of water filtration systems and purification tablets. It plays in energy, working its electrical conductivity in batteries and rechargeable batteries.

Technology needs the element of silver for touch screens, smart phones, computers, hard drives, and memory modules. It creates catalytic converters within cars and is even employed in spacecraft safety operation. Silver is an underlying element in our lives and may be a prominent one in preparing for your retirement.

Make Your Self-Directed Gold IRA Metallic

As all IRA-allowable precious metals are considered alternative assets, you cannot invest in silver through a standard brokerage account. With a Gold IRA, you can add this adaptable metal to your retirement portfolio in a manner that complies with the IRS.

In terms of keeping things IRS-compliant, your silver must uphold specificities to be labeled eligible as an IRA investment. Self-Directed Gold IRAs prohibit the investment in any product that may be deemed collectible. Certain forms of silver and gold are not up to par and could be viewed as such. Your silver needs to meet the fineness requirement of 99.9% purity to count as a certifiable Gold IRA investment. In some cases, if your silver is minted by the government (e.g. American Eagle Coins) it does not need to meet the fineness requirements.

Your Self-Directed IRA custodian will hold custody of the precious metals you invest in. The typical method for storing your silver is trusting its security in an approved depository.

This Shiny Gray Glimmers Your Gold IRA

Traditionally, IRA-allowable invested silver comes in the form of certain proof coins, bullion coins, and silver bars.

Silver bars typically cost less than coins, making them a prime instrument for those looking to open and fund a Gold IRA. Additionally, investing in silver bars of substantial amounts tends to be a cost-effective choice.

You Can Have Wisdom and Silver and Gold

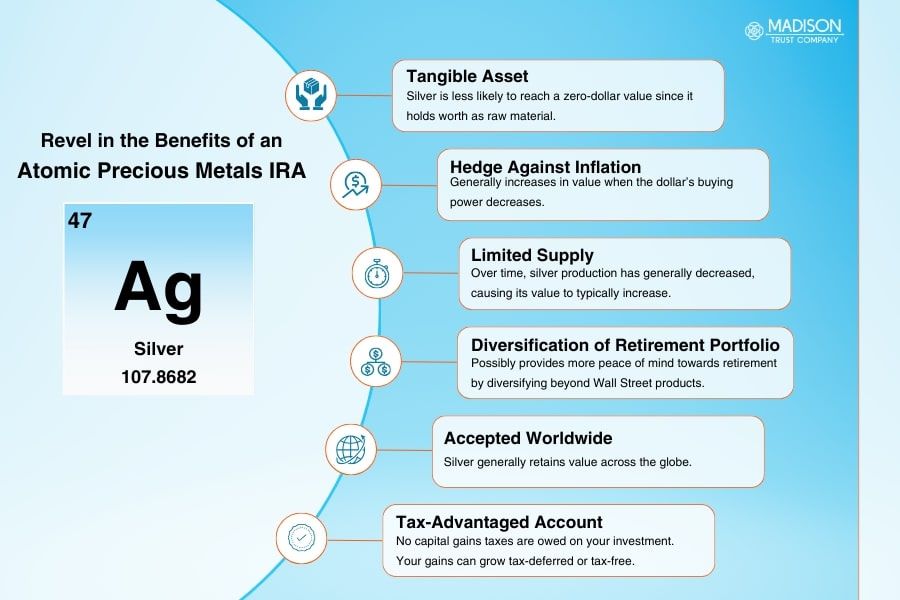

Silver has historically demonstrated itself to be an asset that maintains purchasing power. When cash begins to depreciate, or the stock market hits a downward trend, silver will typically flourish in value. Silver generally has tremendous liquidity; as there’s usually a consistent surge in demand due to its limited supply, it remains an easy asset to trade.

Investing in silver can provide a myriad of advantages. Accompany this earth metal with the tax-advantaged vehicle that is the Self-Directed Gold IRA, and you’ve got yourself your own atomic investment.

Keeping Your Gold IRA Monochromatic

Investing in silver with a Gold IRA brings a potential source of revenue that sits beyond Wall Street products. Adding silver to your investment repertoire not only diversifies your retirement portfolio, but it may provide peace of mind in the future. Investing in a variety of alternative assets and Wall Street products is considered best practice to aim to retire comfortably.

Conclusion: Illuminate Your Future with a Silver Radiance

Silver is a rare earth metal worthy of marveling. It aids in modern medicine, its healing properties delivering miracles for medical professionals, scientists, and the technologically adept. It’s reasonable to assume you’re encountering or using silver in some form, every day.

Beyond this, silver can be applied towards your retirement savings through the Self-Directed Gold IRA. It can potentially safeguard you during your years of retirement.

Interested in Precious Metals?

Our Self-Directed IRA Specialists harbor knowledge on an abundance of alternative asset classes. We’re here to educate you on the self-directed investing process. Place a free discovery call today and identify the type of investor you’re destined to be!