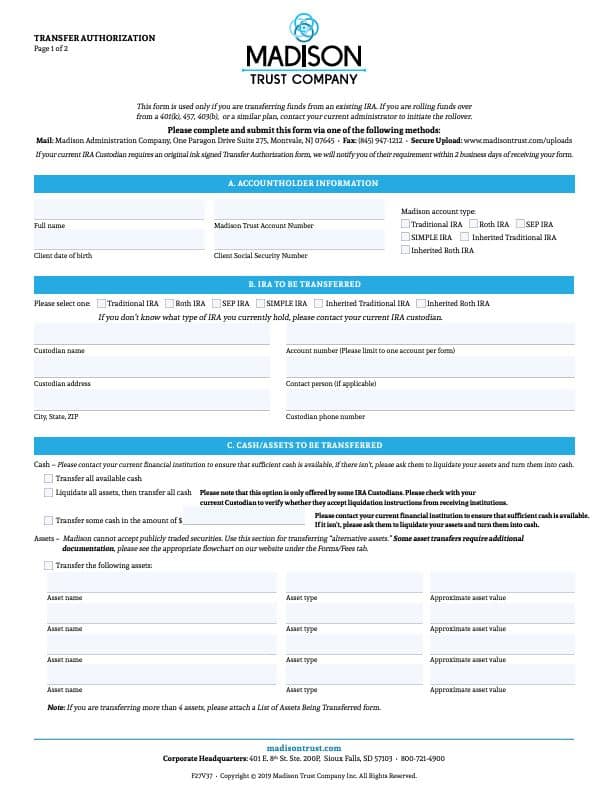

How To Complete a Transfer Authorization Form

Are you looking to transfer funds from an IRA at a brokerage to your new Self Directed IRA at Madison Trust? If so, you’re in the right place! The transfer process is fairly simple and starts by filling out the Transfer Authorization Form.

An accurately completed form will allow you to have a hassle-free transfer so you can start investing quicker and achieving your retirement goals. Let’s go over the step-by-step instructions of how to fill out Madison Trust’s Transfer Authorization Form.

Complete Step-by-Step Guide: How To Fill Out the Transfer Authorization Form

To ensure each section of the Transfer Authorization Form is completed correctly, please refer to the following:

Section A: Accountholder Information

Please fill in your full legal name as it appears on your account, date of birth, social security number, Madison Trust account number (starts with the letter M and can be found in the Welcome Email sent when the account was established), and type of Self Directed IRA held at Madison Trust.

Section B: IRA To Be Transferred

Please fill in the following information about the IRA at the financial institution you are transferring from:

- Account Type – Type of IRA you are transferring from your current custodian.

- Custodian Name – Name of financial institution you are transferring funds and/or assets from (e.g., Fidelity, Vanguard, Equity Trust, etc.).

- Account Number – IRA account number at the financial institution you are transferring from.

- Custodian Address – Address of the financial institution you are transferring from.

- Contact Person – If you have a direct contact at your financial institution, feel free to include their name, otherwise, leave this line blank.

- Custodian Phone Number – Phone number of financial institution you are transferring from.

Section C: Cash/Assets To Be Transferred

Please indicate the amount of funds and/or assets you would like to be transferred from your current IRA to your new Madison Trust Self Directed IRA. You can choose to transfer all available cash, liquidate your assets then transfer cash, transfer a specific amount of cash, or transfer certain assets.

Please only select one of the 3 cash options listed. If you are transferring alternative assets, you may also select Option 4: “Transfer the Following Assets” and complete the asset information.

- Option 1: Transfer all available cash – Transfer all cash available from the IRA referenced in Section B.

- Option 2 - Liquidate all assets, then transfer all cash – Instruct your custodian to liquidate all assets and then transfer all remaining cash. Please note that for this option, not all custodians accept 3rd party written liquidation instructions. If you are unsure, it is recommended to contact your custodian to liquidate the account before submitting the transfer request.

- Option 3 - Transfer some cash in the amount of – Write/type in the exact amount of cash you want to transfer from your custodian. Please ensure that amount is available along with any potential processing fees that may be charged by your other custodian.

Please note: "Transfer all available cash” and “Liquidate assets then transfer all cash” cannot both be selected, as choosing both often results in a rejection for conflicting instructions. If the account has already been liquidated, please select “transfer all available cash”. If the account still needs to be liquidated, please select “liquidate assets, then transfer all cash”.

- Option 4 – Transfer the following assets – List the asset name, type, and approximate value for any assets you would like to transfer to Madison Trust Company. Please note that Madison Trust Company DOES NOT hold publicly traded assets such as stocks, ETFs, Mutual Funds, or bonds. These assets must be liquidated prior to a transfer to Madison Trust and transferred as cash or remain in the previous custodian’s account.

- Asset Name: Legal name of asset

- Asset Type: Examples – IRA LLC, Promissory Note, Real Estate, Private Placement

- Approximate Asset Value: Most up to date valuation of asset

- If you would like to transfer both cash and assets, please select “transfer a specific amount” and “transfer certain assets”. For example, assume you would like to transfer $10,000 cash and your LLC that holds real estate valued at $48,000. Please complete the form as follows:

- Transfer some cash in the amount of: $10,000

- Transfer the following assets:

- Asset Name: Name of Your LLC

- Asset Type: LLC

- Approximate Asset Value: $48,000

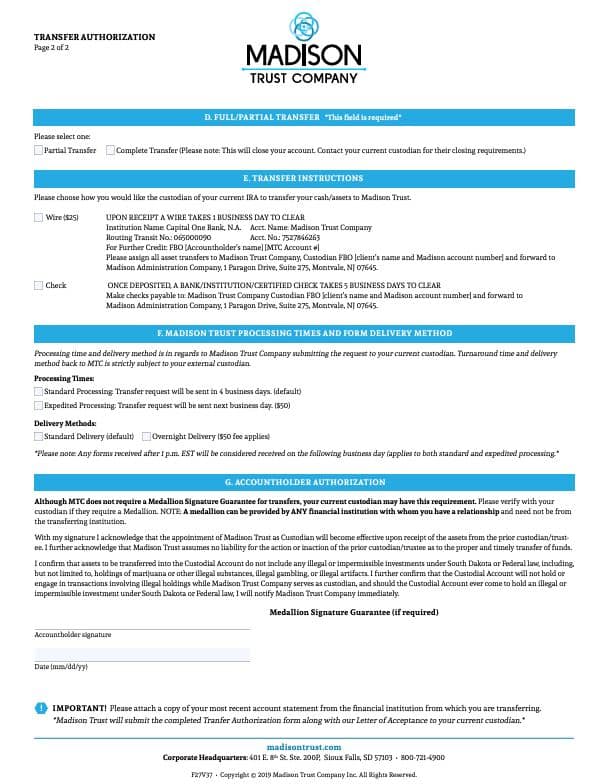

Section D: Full/Partial Transfer

Please select whether this is a Partial Transfer or a Complete Transfer.

- Partial Transfer - Transfer part of your account from your previous custodian. Any transfer that does NOT include ALL assets and/or cash from the IRA listed on the Transfer Form would be classified as a partial transfer.

- Complete Transfer - Indicates to your previous custodian that you want to close your account with them and transfer all available cash and/or assets from this account.

Section E: Transfer Instructions

Please select whether you would like the financial institution holding your current IRA to transfer your funds to Madison Trust via wire or check.

- Wire – Instructs your other IRA custodian to transfer the funds via wire. Please note that Madison Trust Company charges a $25 incoming wire fee, and the funds clear the following business day from when they are received.

- Check – Instructs your other IRA custodian to mail a check for the funds being transferred. A check will take 5 business days to clear after being deposited.

Please Note: We will request the funds be transferred in the method you select, but other custodians may have their own processing guidelines that do not allow for the selected method.

Section F: Madison Trust Processing and Delivery Method

Please select the processing time and delivery method you would like Madison Trust to submit the request to your current institution.

Processing Times – Processing time for Madison to submit the form to your current custodian once it is received on our end. Forms received after 1 PM EST are considered to be received the following business day. Please note our processing timeframe DOES NOT include the transferring custodian’s processing time. Turnaround time and delivery method back to Madison Trust is strictly subject to your external institution's processing time and procedures.

- Standard – 4 business days

- Expedited – Next Business Day ($50 Fee)

Transfer Form Delivery Methods – Industry standard is to submit requests via fax or email unless the other custodian only accepts physical copies via mail. Therefore, all forms default to standard delivery unless the respective custodian only accepts transfer forms by mail. If the form must be mailed, we will process it according to the Standard Delivery (typically 3-4 business days once mailed) or Overnight Delivery selection ($50 fee).

Please Note: If this Section is left blank, we will default to Standard Processing and Standard Delivery (if applicable).

Section G: Accountholder Authorization

Please sign and date the form in ink. Please provide a Medallion Signature Guarantee (if applicable).

- Accountholder Signature – Your Signature. Please note that most custodians will require an ink signature on the form in order to process a transfer request. If you are unsure if your custodian will accept an electronic signature, please feel free to contact them directly or reach out to us and we will let you know based on our internal records.

- Date – Date of signature.

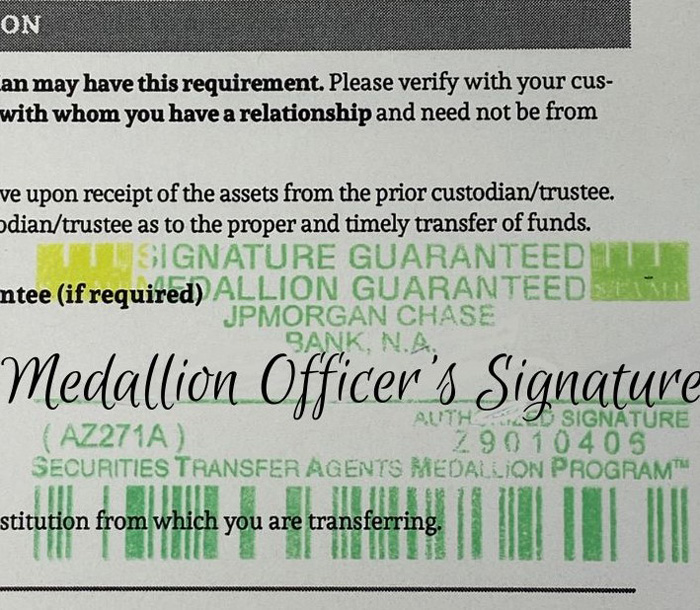

* Medallion Guarantee (if required) * - Madison Trust Company does not require a Medallion Signature Guarantee in any way, however some other custodians do. Other custodians who require a Medallion Signature Guarantee will reject transfer requests if the Medallion Signature is not included and clearly legible on the form. If you are unsure of your current custodian’s requirement, please see their website or contact them directly. For more information regarding Medallion Guarantee Signature’s and where to obtain one, please see our step-by-step guide.

IRA Transfer Next Steps

Once completed, the Transfer Authorization Form can be submitted to Madison Trust’s secure uploads portal. After we receive the form, we will submit the request to the institution currently holding the IRA.

You Have Questions? We Have Answers!

Please feel free to contact one of our knowledgeable and friendly Transfer Specialists with any questions. Call 800-721-4900, Option 2. You can also email [email protected].

Conclusion: Let's Put It All Together

Nice work! You have filled out the Transfer Authorization Form with ease. If our Transfers Department has any questions, we will reach out to you. If everything is all set, you will receive an automated email to let you know that your transfer request has been sent.

The timing of when you will receive the funds in your Madison Trust account depends on the receiving institution's processing times and procedures. If you have any questions about your transfer status, please contact your previous IRA institution.

For more information about transfers, please visit How To Transfer Funds to a Self Directed IRA: Step-by-Step Guide.

When your funds are received in your Madison Trust account, you will receive an automated email to let you know. For more information about Self Directed IRA transfers, please visit our account funding FAQs. If you are looking to rollover a qualified retirement account, such as a 401(k) or 403(b), learn more about the rollover process in the Self Directed IRA Rollover – A Complete How-To Guide.