Investing in Mobile Homes with a Self-Directed IRA

Written By: Daniel Gleich

Key Points

- Self-Directed IRAs (SDIRAs) can invest in mobile homes, offering an affordable alternative to traditional homes for generating rental income and diversifying retirement portfolios.

- Investing in mobile homes or mobile home parks with an SDIRA can yield potentially high returns due to lower purchase costs, loyal tenants, and growing demand for affordable housing options.

- Mobile homes present an exciting investment opportunity as they are considered personal property in parks and can also be combined with land ownership.

Generating rental income within a Self-Directed IRA (SDIRA) typically involves a sizable upfront investment for a down payment on a property. However, an alternative path exists — your Self-Directed IRA can invest in mobile homes.

Mobile homes are often significantly more affordable than traditional homes. This opens up possibilities for accruing passive income in your retirement account, without requiring heavy capital to get started. Here's why using your SDIRA to invest in mobile homes could be an effective strategy as part of a diversified retirement portfolio.

Investing in Mobile Home Units

Around 20 million Americans live in mobile homes, and the number is growing. Investing in mobile home units can align your retirement funds to this projected growth.

On average, new mobile homes in the U.S. cost $127,300. A used model costs between $10,000 and $100,000. Let's say your Self-Directed IRA purchases a used mobile home for $10,000 upfront. You might then rent it to a tenant who pays $300 monthly and covers the mobile home lot fee.

After three years, you would have recouped your initial investment, leaving you with $300 a month in tax-free (Roth) or tax-deferred (Traditional) profit depending on the type of SDIRA you chose to open.

You could also sell your mobile home. Say the borrower makes payments for three to 15 years and pays an interest rate of up to 12%. Once the loan was repaid, your Self-Directed IRA would receive regular income from the sale.

Technically, mobile homes in parks are considered personal property, not real estate. The distinction lets your investment generally avoid many of the regulations other investment properties fall under, which can be beneficial if you prefer a hands-off approach to investing in real estate.

If your Self-Directed IRA owns land, you can combine this with a mobile home investment. This, however, would be considered a real estate investment. You can rent the unit and charge a fee equivalent to the lot rent.

Investing in Mobile Home Parks

If you don't want to be a landlord, there is another way to invest in mobile homes with your Self-Directed IRA — through mobile home parks. Mobile home parks are communities where people rent or own the land and pay a fee for the lot.

The park owners are responsible for maintaining the common areas. Your Self-Directed IRA can purchase a lot in a park and receive rental income from tenants.

Alternatively, you could invest in a mobile home park through a private Real Estate Investment Trust (REIT). This allows your retirement account to own a stake in multiple parks and benefit from diversification without being responsible for managing individual properties.

Benefits of Investing in Mobile Homes with a Self-Directed IRA

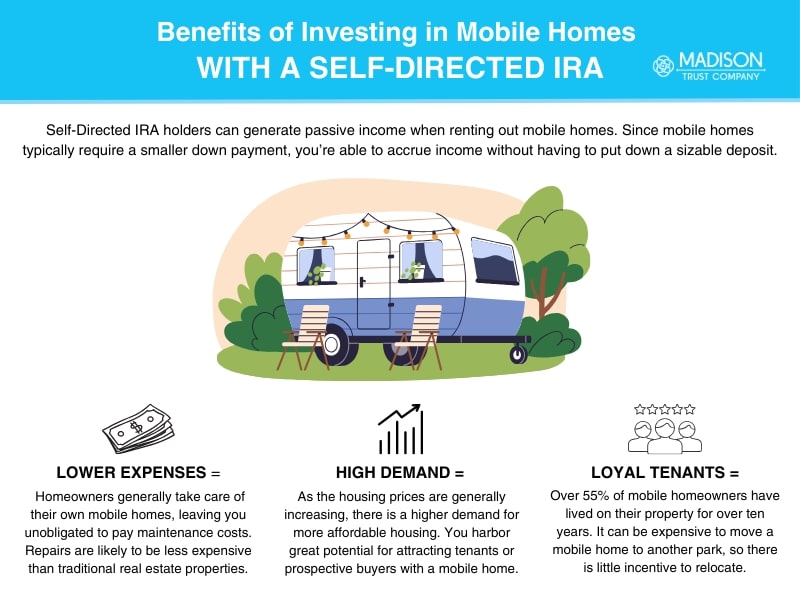

One of the primary benefits of investing in mobile homes with your Self-Directed IRA is the potential for high returns. Mobile homes have lower purchase prices and can generate consistent rental income whether you buy a home or land. Additional benefits include:

Loyal Tenants

Over 55% of mobile homeowners say they've lived in their property for at least ten years. Moving a mobile home is typically expensive, and there's little incentive to do it if a tenant is happy at the park. Even mobile home renters are likely to stick around.

Lower Expenses

Mobile homes come with lower expenses than traditional real estate investments, such as single-family homes or apartment buildings. Homeowners take care of their mobile homes themselves, so you don’t have to deal with maintenance costs. If your Self-Directed IRA owns the home, repairs will likely still be less expensive than those at a traditional home.

High Demand

With home prices increasing, mobile homes are in high demand as people seek affordable housing options. This means your Self-Directed IRA might be able to attract a steady stream of potential tenants or buyers for your mobile home investments.

Is Investing in Mobile Homes Right for You?

While investing in mobile homes with a Self-Directed IRA can be a lucrative and accessible option, it's important to consider your investment goals and risk tolerance before signing on the dotted line for a mobile home or lot. If you're ready to invest in alternative assets with tax advantages, you can get started by opening a Self-Directed IRA with Madison Trust. Schedule a free discovery call today!