Last Minute Gift Idea: Naming a Beneficiary for Potential Generational Wealth

Written By: Daniel Gleich

Key Points

- Naming a loved one as a beneficiary of your Self-Directed IRA (SDIRA) will impart a memorable gesture this holiday season.

- Self-Directed IRAs grant investors the opportunity to govern their retirement account through alternative investing.

- Naming a beneficiary is not only fulfilling for the inheritors, but also beneficial for the account owner as it grants peace of mind to both parties.

- The parameters of an Inherited IRA differ according to the relationship between the original account holder and beneficiary.

Every holiday season, we peruse through search engine links and social media pages in pursuit of the perfect gift. We hope for that remarkable suggestion that will bring our loved ones the most joy. According to an article published by Business Wire, 64.2% of Americans long for assistance with holiday gift shopping.

Making life easier for our loved ones is a universal wish. If you could conjure the perfect present, it may be something useful throughout the recipient’s lifetime. What could be more generous than helping them work towards a better financial future? To potentially safeguard those you cherish, you can choose to enroll them as beneficiaries of your Self-Directed IRA.

Design Your Fiscal Destiny with a Self-Directed IRA and Alternative Investments

A Self-Directed IRA (SDIRA) is an individual retirement account that is administered by a custodian or trustee and directly managed by the account holder. Unlike a standard IRA that allows you to invest in stocks and bonds, Self-Directed IRAs give you the chance to dabble in alternative investments. Alternative investments include specialties such as real estate, promissory notes, private placements, precious metals, and more.

These investments can render exciting opportunities as it allows you to place your money beside a passion or skillset.

A beneficiary of your SDIRA is an elected individual or entity who will inherit authority and access to your retirement account in the event of your passing. Naming beneficiaries for your Self-Directed IRA can generate peace of mind.

Establishing an account will guarantee your loved ones are the sole benefactors of your accrued retirement funds or assets. This will also leave a legacy behind and allow wealth to prosper amongst your loved ones.

How Inheritance Unfolds for Beneficiaries

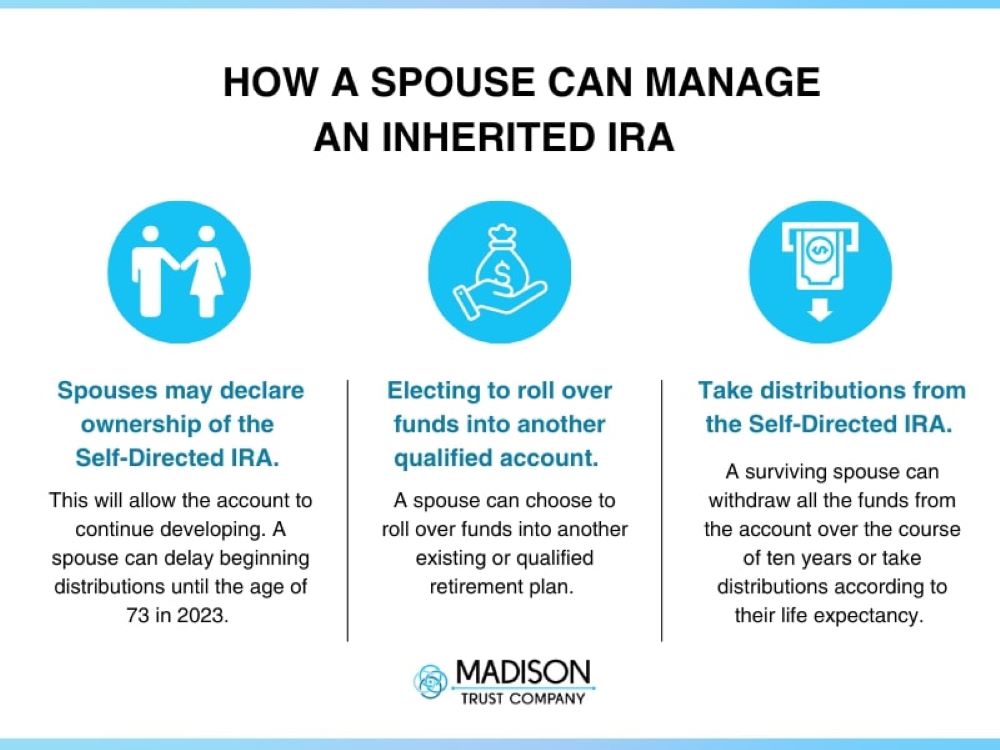

Several types of IRAs can become an Inherited IRA or Beneficiary IRA. The differences that surface depend on the type of relationship existing between the account holder and the beneficiary. A spouse (who is a type of eligible designated beneficiary) typically has the greatest amount of flexibility, so long as they are the only beneficiary of said account.

There are two types of beneficiaries: eligible designated beneficiary and designated beneficiary. An eligible designated beneficiary (EDB) must possess one of the following qualifying factors:

- Be chronically ill or disabled.

- Be a spouse or minor child of the deceased account holder.

- No more than ten years younger than the IRA owner.

EDBs can take distributions according to their own life expectancy, or over the course of ten years. Designated beneficiaries only have the option of receiving all the account’s distributions over the ten-year time frame.

While distributions may be received in different ways, this shouldn’t deter you from naming someone you care for as a beneficiary. Regardless of the exact details of the relationship, they will still inherit the entirety of the account. Learning how much they mean to you will undoubtedly leave a lasting and unforgettable impression that lingers on.

Conclusion: May Your Holiday Gift Giving Be Merry & Bright

Adding the important people in your life as beneficiaries of your SDIRA is a surprising and deeply meaningful gift. Forego prowling empty-shelved department stores and social media scrolling. Instead, give your most treasured the gift of a bright financial future.

Wrap It Up with A Bow

Madison Trust is eager to facilitate in making this holiday season’s gift giving seamless. We’re here to answer any questions for existing Self-Directed IRA owners, or those hoping to embark on their investing journey. A Self-Directed IRA Specialist can help you understand all the components.

With customer care as our greatest concern, we are here to support you. Schedule a free discovery call at your earliest convenience.