How to Gain Control of Your Investments With a Self-Directed IRA

Written By: Daniel Gleich

Key Points

- You can grow your retirement savings through a variety of alternative assets with a Self-Directed IRA.

- By investing in alternative assets, you can diversify your retirement portfolio and hedge against inflation.

- With a reputable Self-Directed IRA custodian like Madison Trust, you'll receive guidance at every step of the way — from opening your account to placing your investment.

If you’re saving for retirement, there’s a good chance you have a Standard IRA. While this type of account offers many benefits, it also limits your investment options. With a Standard IRA, you must stick to stocks, bonds, and mutual funds. You don’t have the opportunity to diversify your retirement portfolio and invest in alternative assets that align with your knowledge, passion, or expertise.

The good news is there is another type of retirement account that opens the doors to alternative assets, like real estate, precious metals, and promissory notes. It’s called a Self-Directed IRA and can help you gain greater control, autonomy, and flexibility of your retirement investing. Keep reading to learn more about what a Self-Directed IRA is and how it works.

What is a Self-Directed IRA?

A Self-Directed IRA is a type of Individual Retirement Account that gives you the freedom to invest beyond Wall Street products. Once you open an account, you can save for retirement with just about any alternative asset you can think of. The sky is truly the limit. You’ll find that a Self-Directed IRA is a powerful retirement vehicle that offers more freedom and flexibility than a Standard IRA.

Types of Alternative Assets

With a Self-Directed IRA, the investment opportunities are endless. Here are some of the most popular alternative products you may decide to invest in:

- Real Estate: Commercial real estate, residential properties, raw land, fix-and-flips, vacation homes, and much more!

- Private Placements: Private equity, private debt, hedge funds, REITs, and other companies and stocks not sold publicly.

- Precious Metals: Gold, silver, platinum, and palladium meeting the minimum fineness requirements.

- Startups & Crowdfunding: Local businesses, healthcare startups, tech companies, crowdfunding opportunities, and many other ventures.

Self-Directed IRA Options

Not only does a Self-Directed IRA allow you to choose your investments, it can also give you the chance to choose your tax benefits. There are four different types of Self-Directed IRA accounts, including.

- Self-Directed Traditional IRA: Just like a Traditional IRA, you contribute pre-tax dollars, potentially reducing your current taxable income. All your earnings will grow tax-deferred.

- Self-Directed Roth IRA: With a Self-Directed Roth IRA, you contribute after-tax dollars. All your earnings grow tax-free.

- Self-Directed SEP IRA: Created for business owners and self-employed individuals, a Self-Directed SEP IRA allows you to make contributions as the employer. These contributions are tax-deductible for your business in the amount of 25% of your employees’ net compensation or at max $69,000 in 2024.

- Self-Directed SIMPLE IRA: A Self-Directed SIMPLE IRA is a tax-deferred account for small business owners with less than 100 employees who don’t offer other retirement plans. It may also be an option for self-employed individuals and sole proprietors. With a Self-Directed SIMPLE IRA, you can help both your employees and yourself save for retirement.

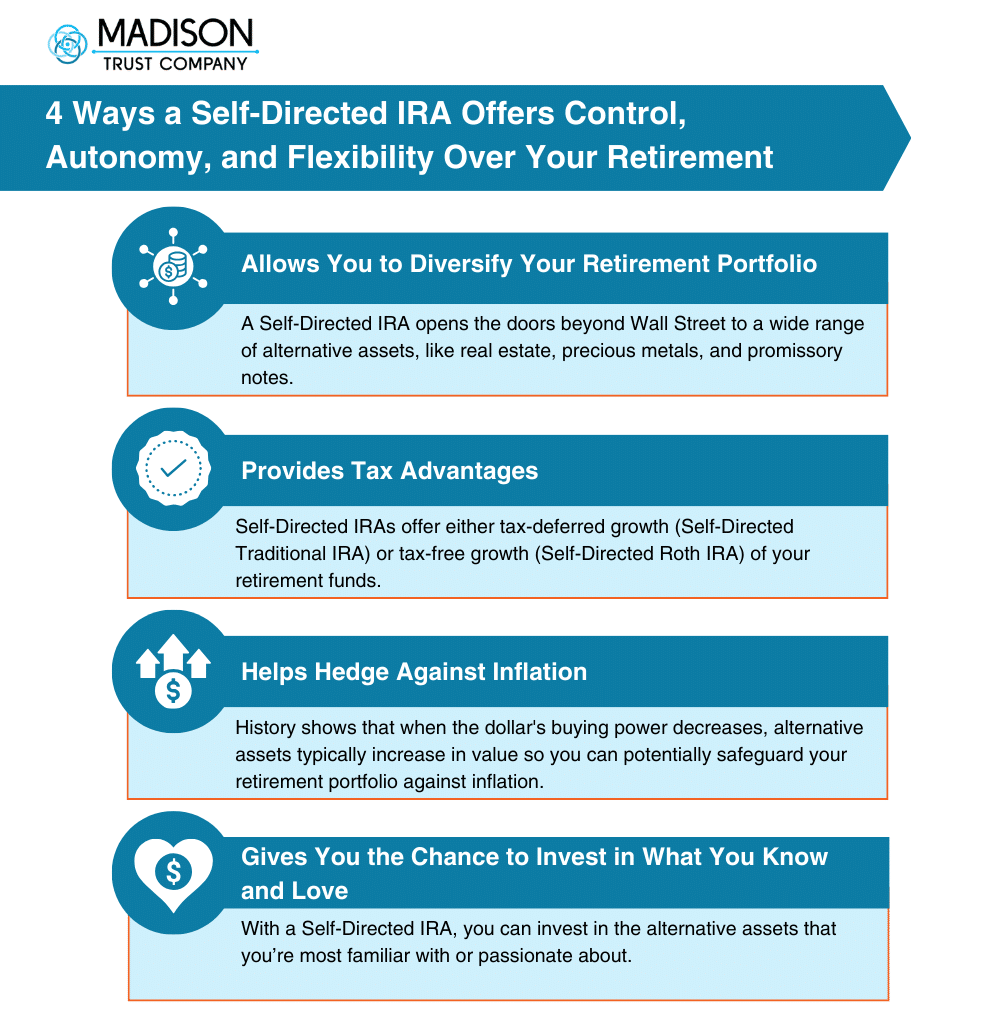

Benefits of Self-Directed IRA

There are a number of noteworthy perks you can enjoy if you take the plunge and invest for retirement with a Self-Directed IRA. Here are several of them:

Diversify Your Retirement Portfolio

Investing in alternative assets through a Self-Directed IRA allows you to diversify your retirement portfolio with investments beyond Wall Street.

Receive Tax Advantages

Self-Directed IRAs offer either tax-deferred growth (Self-Directed Traditional IRA) or tax-free growth (Self-Directed Roth IRA) of your retirement funds.

Hedge Against Inflation

History shows that when the dollar's buying power decreases, alternative assets typically increase in value so you can potentially safeguard your retirement portfolio against inflation.

Invest in What You Know and Love

With a Self-Directed IRA, you can invest in the alternative assets that you’re most familiar with or passionate about.

Start Your Self-Directed IRA Investing Journey Today

For more information about investing in alternative assets through a Self-Directed IRA, schedule a discovery call with Madison Trust. We look forward to hearing from you!