Exploring the Limits: Can I Buy Stocks with a Self-Directed IRA (SDIRA)?

Written By: Daniel Gleich

Key Points

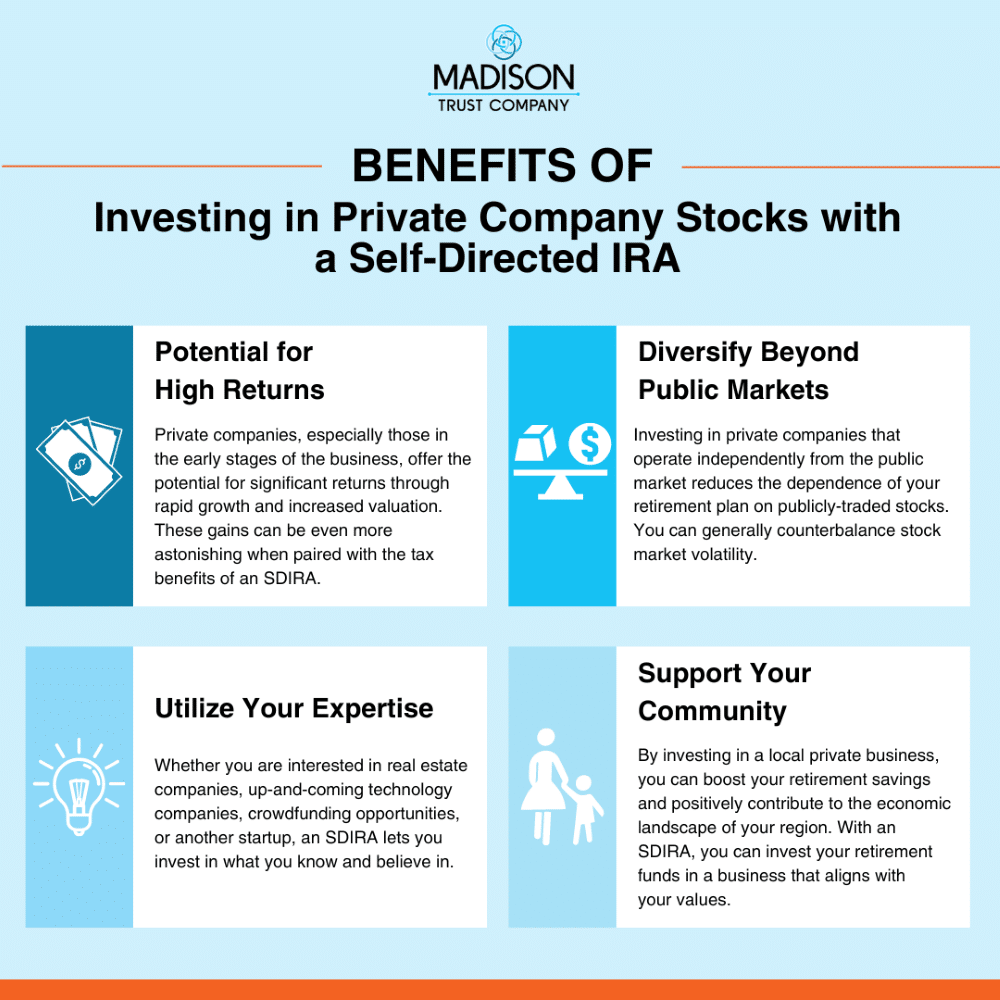

- While it depends if the Self-Directed IRA (SDIRA) is administratively set up to invest in stocks and bonds, all SDIRAs have the exciting opportunity to invest in shares of privately held companies.

- When you invest in private company stocks with an SDIRA, you can potentially receive high returns, diversify beyond the stock market, and utilize your expertise to invest in what you know and believe in.

- Madison Trust’s Specialists can let you know your self-directed investment options and address any other questions about self-directed investing.

Investing for the future is a key aspect of financial planning. Investors constantly look for ways to explore diverse avenues to grow their wealth. Self-Directed IRAs (SDIRAs) offer the exciting opportunity to invest in alternative assets, such as real estate, precious metals, and promissory notes.

The primary benefit of investing with a Self-Directed IRA is to invest in alternative assets within a tax-advantaged account. But what if you are also looking to invest in standard Wall Street products such as stocks, bonds, and mutual funds?

We often receive calls and emails from our clients wondering, “Can I buy stocks with a Self-Directed IRA?” As the answer is not a simple yes or no, we’ll dive into the rules surrounding Self-Directed IRAs, including if you can invest in stocks.

Understanding the Limitations: Self-Directed IRAs and Wall Street Products (Stocks, Bonds, and Mutual Funds)

Self-Directed IRAs can invest in publicly traded stock if the SDIRA is administratively set up to do so. It is considered best practice to speak with the Self-Directed IRA custodian you wish to open your account with to determine if they allow for the investment in stocks.

Self-Directed IRAs are known for providing the freedom to invest beyond the confines of Wall Street. Self-directed investors take advantage of the opportunity to invest in alternative assets typically inaccessible in a standard brokerage account.

Unique Investment Opportunity: Private Company Stock

Self-Directed IRAs allow investors to diversify their retirement portfolio with private company stocks, also known as private equity or private placements.

Benefits of Investing in Private Company Stocks with a Self-Directed IRA

How To Invest in Private Company Stocks with a Self-Directed IRA

Open

Open a Self-Directed IRA with Madison Trust by completing our easy online application.

Fund

Fund Your Self-Directed IRA by transferring or rolling over all - or a portion of - your funds from an existing retirement account, such as an IRA or 401(k), or by making an initial contribution.

Invest

Invest in a Private Company by instructing Madison Trust to send your IRA funds by writing a check or sending a wire directly to your investment.

For information regarding the documents needed to invest in a private placement, view our flowchart How To Invest Your IRA into a Private Placement.

What To Know Before Investing in a Private Company Stock with a Self-Directed IRA

Conduct Due Diligence

It is considered best practice to conduct thorough due diligence before investing. Like a public company, you may want to explore its financial health, leadership team, growth potential, and business strategy.

Unrelated Business Income Tax (UBIT)

If the company is a pass-through entity (i.e., LLC) and receives ordinary income (for goods and services), then your IRA may be subject to UBIT. It’s considered best practice to contact a financial advisor or CPA to understand any potential taxes incurred by their investment.

Eligibility

Depending on the company, some types of investments require the investors to be accredited investors.

Prohibited Transactions

If a disqualified person owns 50% or more of an existing company, then the SDIRA cannot purchase shares or units of that company. For more information, please visit prohibited transactions.

Increased Investment Access

Some companies can be invested in through crowdfunding opportunities, granting investors access to larger, generally more lucrative investments.

Why Not Both? Stocks and Alternative Assets

When preparing for your financial future, you may have heard the phrase “Don’t put your eggs all in one basket”. This short saying is profound. Typically, it is considered best practice to diversify your retirement portfolio with a variety of assets, both alternative investments and stock market products. This can safeguard your retirement portfolio from market volatility. Savvy investors generally have multiple retirement accounts to accomplish this diversification strategy.

Conclusion: Let's Tie It All Up

The ability of a Self-Directed IRA to invest in private company stocks provides a unique and potentially rewarding investment opportunity. As with any investment, careful consideration, due diligence, and compliance with IRS regulations are paramount.

You Have Questions? We Have Answers!

Schedule a free discovery call with a Self-Directed IRA Specialist to get your questions answered about self-directed investing. Our knowledgeable, friendly, and professional team is here to help!