Nothing but Net: Sidestepping Prohibited Transactions

Written By: Daniel Gleich

Key Points

- If your movement is categorized as a foul during a basketball game, you can potentially put you and your team at risk. Similarly, if you participate in prohibited transactions with a Self-Directed IRA (SDIRA), you can put your account at risk.

- A multiplicity of fouls and prohibited transactions exist. It’s considered best practice to familiarize yourself with them to aim to avoid penalties.

- Foul types can range from unnecessary contact to unsportsmanlike behavior. Self-Directed IRA prohibited transactions can vary, but Madison Trust has the educational resources to help you learn about different prohibited transactions.

Basketball is a treasured sport in our nation, having been an Olympic event since 1904. In general, basketball has been playing the long game and has built quite a legacy. In parallel, preparing for your retirement is a process that typically leads to evolution over time. Accompanying patience with a Self-Directed IRA and habitual observation may emerge a possible lasting and fruitful future. Given its potential, you would probably prefer to not risk your possible fruitful retirement. Participating in a prohibited transaction is one way to likely lose the integrity of your SDIRA.

Likewise, performing fouls amid a heated basketball game could result in disqualifications. Repeat fouls could even get the player terminated. Let’s pivot and cross-examine these concepts with a crossover dribble:

Under a Technicality: Technical Foul and Per Se Prohibited Transaction

A technical foul can be imposed upon more than just the individual player. If anyone conducts themselves in an unsportsmanlike fashion, they are then vulnerable to technical fouls.

This includes coaches, and the entire associated basketball team. Offenses include taunting an opponent or arguing with an official member of the court, such as the referee. Essentially, these acts violate the administrative rules.

A way to contradict IRS rules is to allow your Self-Directed IRA to perform a transaction with a disqualified person. This prohibited transaction occurs when your SDIRA sells, leases, lends money or extends credit, or provides some form of goods and services to an individual that’s disqualified to your IRA. These same transactions are permissible with third party entities, but when implemented with a disqualified person, they are prohibited.

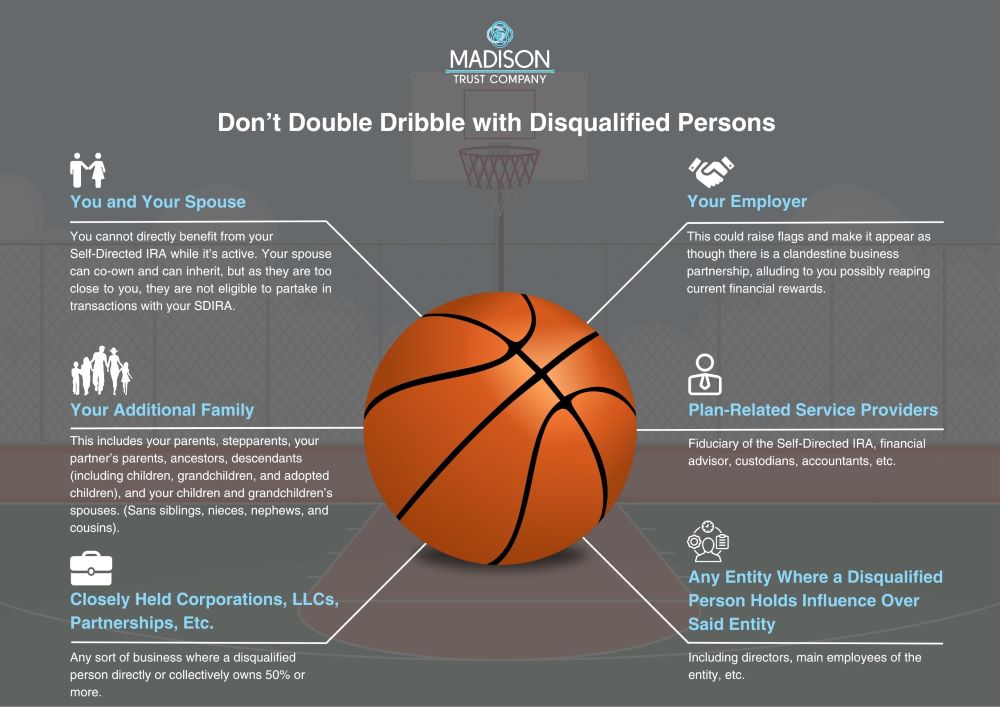

Disqualified persons are typically lineal descendants or closely held entities. Your Self-Directed IRA is established to aid in the better of your retirement – not the present. Here’s some examples of people who should not engage in transactions with your SDIRA:

If you lease a property that your Self-Directed Real Estate IRA owns to your child, this is a conflict. Same goes for renting out your commercial real estate to a company under your ownership. The examples are plentiful; generally, a safe option for investing is with strangers to your personal life and other ventures.

Don’t Take it Personal: Personal Foul and Self-Dealing Prohibited Transaction

A basketball player can incur a personal foul by executing unnecessary physical contact while playing. Blocking, pushing, or striking another player while they’re attempting to make a shot could produce this resolution. If a teammate endures a shooting foul by another team’s player, they earn free throws. The number of free throws depends on whether they were trying to score a two-pointer shot or three-pointer shot, and if they happened to make the shot despite their adversities.

If an investor is not mindful of the self-benefitting rule established by the IRS, they could be at risk of performing a self-dealing prohibited transaction. Plainly stated, if an account holder gains a personal benefit from their Self-Directed IRA investment, their account can become subject to closure and taxes.

An example of a self-dealing prohibited transaction would be using your Self-Directed Real Estate IRA’s vacation property for yourself. It doesn’t matter if an IRA owner rents the property out to themselves or stays on the premises free of charge: these scenarios would result in a prohibited transaction.

Don’t Put Your Dukes Up: Flagrant Foul and Extension of Credit Prohibited Transactions

Perhaps the most extreme version of a foul in the basketball realm is the flagrant foul. These fouls can generate fines, instant ejection, and possible suspension. This violation is excessive and/or indefensible and may even lead to injury of an opposing player.

If this violation happens once, then the other team receives possession of the ball and the chance to free throw. If these interjections are constant and repetitive, then said player is immediately removed from the game, in addition to the other team obtaining possession and free throws.

Securing financial assistance incorrectly from a third-party lender could culminate an extension of credit prohibited transaction. If you’re looking to purchase an investment, but your Self-Directed IRA doesn’t have the full amount of funds needed, you can seek out a loan. However, if you personally guarantee the repayment, it can be considered a benefit to your retirement account.

If the borrower (your SDIRA) defaults on the loan, the lender can pursue the assets within your SDIRA but not your personal assets because the loan was personally guaranteed. In this case, personally guaranteeing the loan would be considered a prohibited transaction. If you’re considering using leverage to fund your SDIRA’s investment, a non-recourse loan would be the most suitable option. Registering for one will make your Self-Directed IRA responsible for repayment, and the collateral, your retirement savings.

What are the Possible Consequences?

When you’ve garnered a foul in basketball, you’re giving your opposing team an advantage. By acquiring free throws and possession, they are now in control. They can score more points, thereby bringing themselves closer to winning the game or sealing their victory's fate. Subsequently, as a fouler, you could possibly owe thousands of dollars in fines and have dampened the morale and spirit of your team.

If a Self-Directed IRA owner makes a prohibited transaction, your IRA would be distributed as of January first of the year the transaction occurred. Even if the amount of money involved in the prohibited transaction was minimal, you could still be subject to taxes according to the amount in your account at time of distribution.

If you are below the age of 59 ½, you would also accrue a 10% early withdrawal penalty charge. Furthermore, if your IRA earned any revenue after the prohibited transaction took place, your account would also be subject to taxes on that sum.

Conclusion: Rebound Your Retirement

Awareness is key to any pursuit, including basketball and saving for your retirement with a Self-Directed IRA. Understanding fouls and prohibited transactions can make it easier to migrate both on the court and in the investment realm.

Madison Trust’s trained Self-Directed IRA Specialists want you to win the game, without going into overtime. Self-directed investing can be easier than a layup. We are readily available to answer your questions and educate you on the best zone defense. Shoot your shot!