Realty to Riches: How Real Estate Can Supplement Income in Retirement

Written By: Daniel Gleich

Key Points

- Real estate is typically seen as a supreme investment choice for Self-Directed IRA (SDIRA) investors.

- Property will likely possess some value, since it is a tangible asset that continues to survive.

- With some planning and foresight, you could possibly use your rental income to cover your required minimum distribution (RMD).

Real estate is generally an exceptionally sought investment for those eager to grow their retirement savings. Due to its lucrative nature and wide array of property types, real estate remains a favored option for first-time investors and knowledgeable moguls. By using a Self-Directed IRA (SDIRA) (also known as an Investment Property IRA) you’re able to garner benefits that aren’t accessible through regular real estate investments.

Many are concerned with supplementing income once they’re no longer receiving compensation from active employment. Investing in real estate with an SDIRA offers you a way to accrue passive income within a tax advantaged account during your retirement years.

Broaden Your Bucks

Diversifying your retirement portfolio can reduce overall risk. Utilizing a Self-Directed IRA to invest in real estate may lead to more predictability. The stock market typically fluctuates, leaving investors to the mercy of its ebbs and flows. Real estate tends to retain value, simply because the property it resides upon is tangible.

Real estate renders such a stark contrast to stock market-based investments. Investment properties can typically behave as a hedge against inflation. Though there is possible risk with any kind of investment, it appears the reward in real estate has the potential to be rather fruitful.

If you opt to hold a rental property, you can determine the cost your tenants owe. Therefore, you can receive a steady, passive income for as long as you have residents living on your property. This is an incredible way to potentially increase your retirement revenue. The more money your account accumulates, the more funds will be available in retirement when you start taking your required minimum distributions (RMDs). RMDs are only required if you have a Self-Directed Traditional IRA.

Tax-Advantaged is the Way to Be

Purchasing real estate through an SDIRA permits tax-advantaged appreciation of your property. Your Investment Property IRA is the owner of your real estate. This allows your earnings to continue to flourish in your account with tax advantages.

A Self-Directed Roth IRA lets your funds grow tax-free. A Self-Directed Traditional IRA will have its taxes deferred. Both account types harbor their own set of benefits.

The account type for you is dependent on your preferences and retirement goals. A Self-Directed IRA custodian can assist you through further explanation and clarification about the traditional and Roth account types.

Preparing for Distributions Does Wonders

As an SDIRA holder, you must partake in mandatory distributions once you reach the age of 73 in 2023. This obligatory withdrawal is referred to as a required minimum distribution (RMD). Prior to reaching this age, it’s considered best practice to establish a plan so that your account does not reduce beyond your liking.

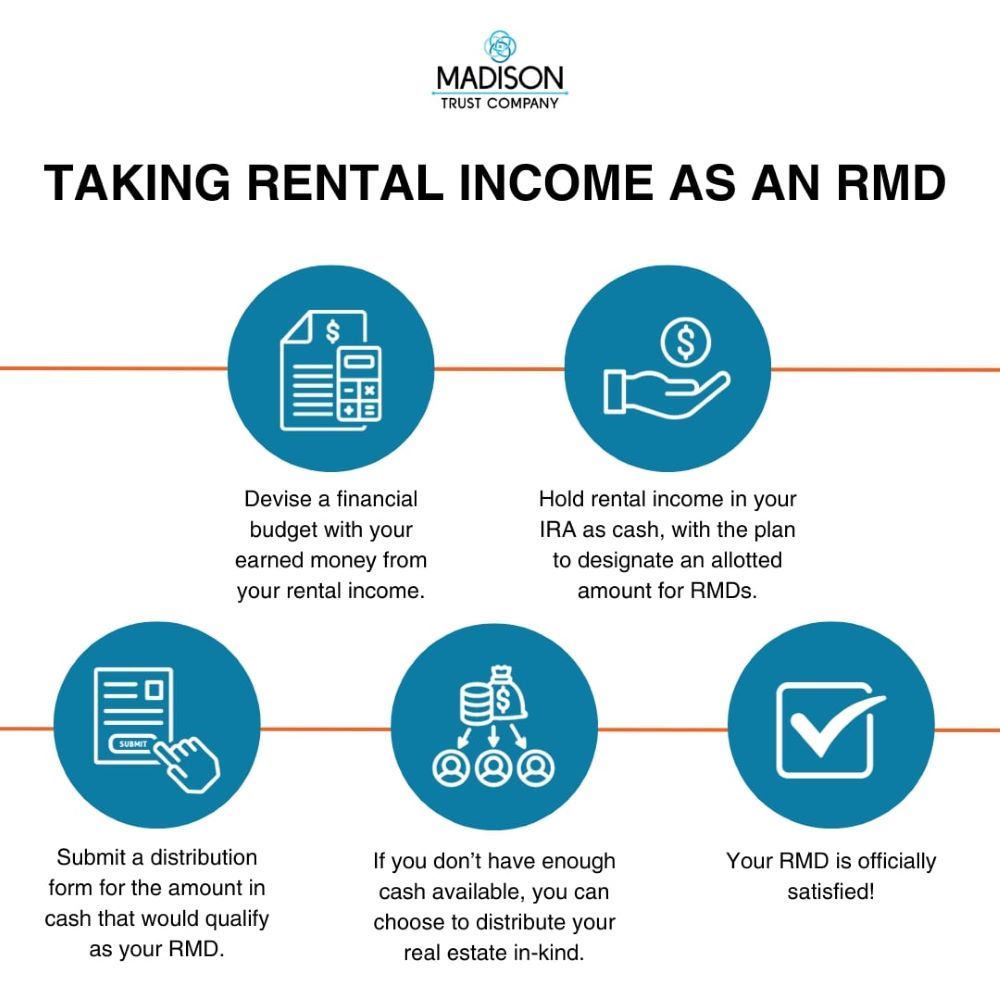

Investing in real estate is considered an excellent instrument to cover your RMDs. It can serve as an investment that may implement passive income into your retirement account. You may consider strategizing a financial plan that causes your rental income to satisfy your RMDs.

Distributing In-Kind

Real estate tends to be one of the prime, lucrative alternative investments. Distributing in-kind is ideal for those who would prefer to cover their RMDs through their physical asset. This may be a favorable exchange in lieu of cash, as real estate tends to increase its value over time.

You have the option of either distributing your property in-full, or to distribute the property partially. Performing the transaction for the whole property is relatively easy. It merely requires compiling and signing the necessary paperwork. For partial distribution, the only exception is you will be noting ownership through percentages.

Conclusion: Round Up Your Funds with Real Estate

Real estate stands as a great vehicle to diversify your retirement portfolio. Furthermore, it can blossom with tax benefits in your Self-Directed IRA. Investing in a rental property is a superb opportunity to gain passive income and help add supplemental funds to your account. By constructing a budget and savings plan, you can use the passive income acquired through renting to satisfy your RMDs.

Invest Like the Adventurer Within

Madison Trust is only a phone call away from getting you on your self-directed investing journey. To ensure you start this voyage with a full knapsack and a laid-out map, reach out to one of our Self-Directed IRA Specialists to get your questions answered!