Becoming a Fix and Flip Connoisseur with a Real Estate IRA

Written By: Daniel Gleich

Key Points

- A Real Estate IRA can possibly benefit you as it allows the funds in your account to develop with tax advantages. Upgrading to an IRA LLC allows your investment account to receive checkbook control, granting you the freedom to place your everyday real estate investment transactions in real-time.

- In addition, being well-versed in the restrictions instilled by the IRS can possibly aid in avoiding unrelated business taxable income or UBIT.

- To help ensure your Real Estate IRA remains compliant, consider alternative approaches to make certain your account doesn’t lose integrity.

Even those with no prior investing experience understand the potential for return in relation to flipping houses. By perusing through the current housing market or stumbling across a home renovation television show, it’s been recognized that refurbishing real estate may equate to a hefty surplus of cash. What isn’t as widely discussed is that you can invest in a fix and flip while receiving tax advantages. Enter the holy grail: the Real Estate IRA.

A Self-Directed Real Estate IRA offers property experts and aspiring restorers the chance to invest in real estate while developing and growing their retirement savings. Through the Self-Directed IRA or SDIRA you can invest in alternative assets like precious metals, private credit, and of course, real estate.

If flipping residences has piqued your interest, continue reading to learn more about the power of a Real Estate IRA.

Collect Your Bearings, Let’s Get to Repairing with a Real Estate IRA

If real estate is your desired alternative investment, then you may want to weigh a few parcels. When participating in home renovation, is your goal to fix and flip a single, discovered rental property? Rather, are you hoping to invest in a handful of properties? If the latter, you can choose to upgrade your Real Estate IRA to a Real Estate IRA LLC or a Real Estate IRA Trust.

Checkbook control can be beneficial for implementing real-time investing. Correspondingly, you’ve garnered the autonomy to execute everyday transactions without the involvement of your Self-Directed IRA custodian. Consider strengthening the power of your Real Estate IRA to the level of an IRA LLC as this account type is ideal for transaction-heavy investments. With an IRA LLC, you gain the power to invest in real time. This account type can also potentially accrue more for your retirement savings, as with an IRA LLC, you avoid transaction fees typically associated with Real Estate IRAs.

Evading Unrelated Business Taxable Income (UBTI)

As a house flipper, there is a term you may want to become acquainted with: unrelated business taxable income, also known as UBTI. As a Real Estate IRA owner, if you are able to perform multiple fix and flips successively in a relatively short amount of time, you may not be viewed as a passive investor. Flipping is a practice that generally creates earned income as opposed to passive income, which is why doing so may put you on the IRS’s radar. Your repeated transactions could be deemed as something utilized to benefit you in the present day - not during your retirement.

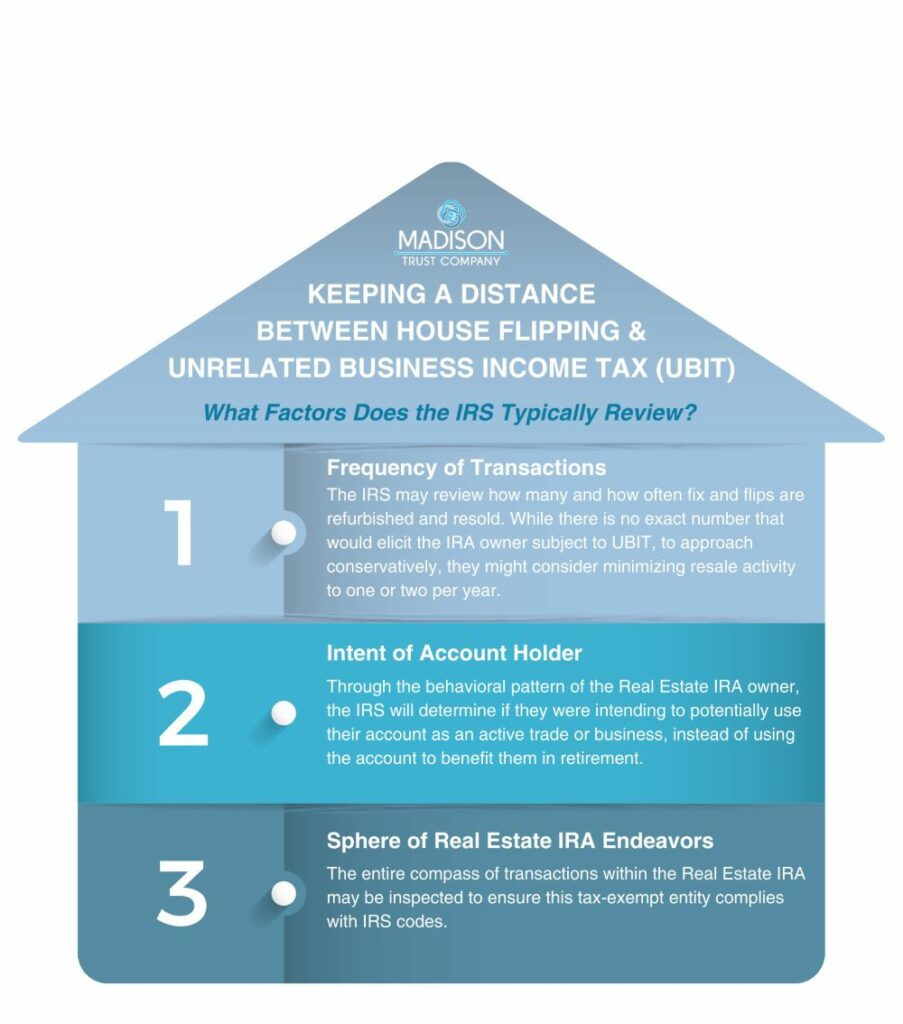

Generally, there is no exact number of fix and flips to perform under your Real Estate IRA that would trigger UBIT (Unrelated Business Income Tax – or the tax that you would incur if your investments were seen as having generated UBIT.) This determination would be made by the IRS, after they examine certain factors. Overall, they are typically searching for proof that these endeavors were completed for an active trade or business as opposed to investment purposes.

Typically, your Real Estate IRA could trigger UBTI if these bullet points seem erroneous:

If fix and flips was the enterprise you wished to employ to your Real Estate IRA, this news may appear as though you’re in an impasse. Despite this, there are ways in which you can partake in these renovations through this investment vehicle. Let’s dive deeper:

Detailing and Decorating a Docile Real Estate IRA

An occasional fix and flip likely won’t generate UBTI when combined with an otherwise passive IRA retirement portfolio.

For fix and flips, a general rule of thumb to consider is to fix up your investment property, and then maintain it in your account as a rental for the minimum course of a year. This allows you to accumulate potential passive rental income from tenants, while transforming the property. After this year-long period, you can then consider selling the property for a potentially higher value than the original amount it was purchased.

If you’re interested in house flipping but you’d prefer to be a little more indirectly involved, consider having your Real Estate IRA behave as a private lender. This is permissible so long as the investor you’re lending to is not labeled as a disqualified person. Your account can potentially loan money to a borrower through a promissory note secured by real estate. Any interest earned is considered passive income.

For those gung-ho about handling house flipping and merging it with their retirement preparation, there is a method that could potentially assist them in avoiding UBTI. By investing their Real Estate IRA into a UBTI blocker C-corporation, they can consider using the C-corporation to essentially” block” UBTI and instead pay for the possibly lesser corporate tax.

As with any investment, it’s considered best practice for investors to conduct their own due diligence before making any investment decisions. A financial advisor can help calculate which approach may best suit your circumstances.

Conclusion: Revamp Your Real Estate IRA for a Potential Return on Investments

Whether you are window shopping a two to four plex or a single-family residence, a Real Estate IRA serves as a superior apparatus for a potential prosperous retirement. Familiarizing yourself with grounds for UBTI and other tax subjections can possibly lead to the curation of your fix and flip success story.

Want to hit the housing market running? Consider speaking with one of our Self-Directed IRA Specialists. Schedule a discovery call and learn more about all Real Estate IRAs.

Madison Trust is a passive custodian and therefore cannot give any legal or tax advice.