Roses are Red, Violets are Blue, Is a Self-Directed IRA Right for You?

Written by: Daniel Gleich

Key Points

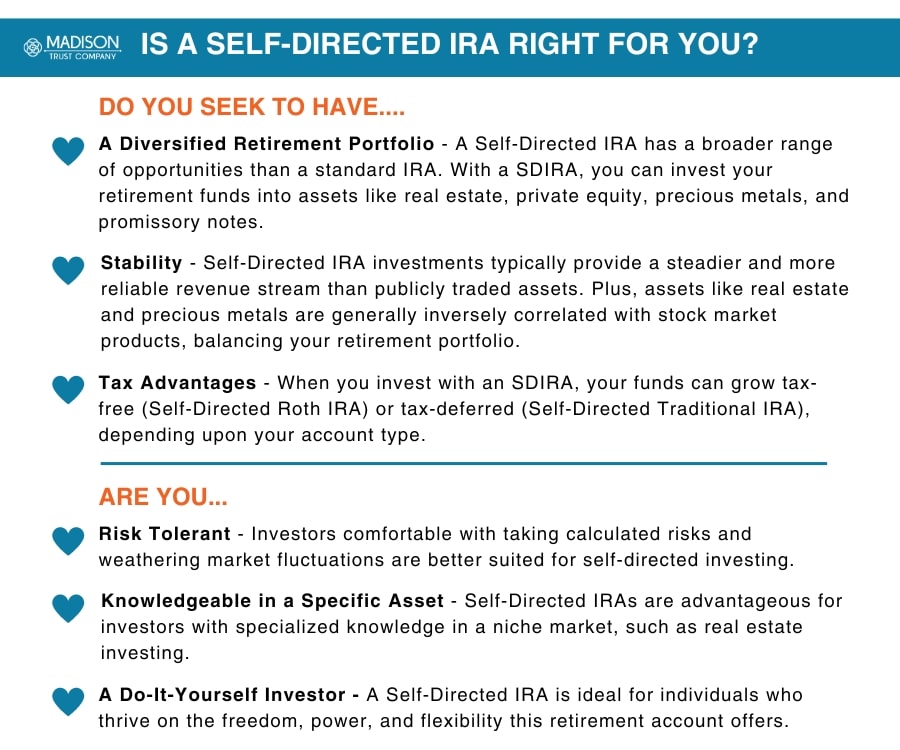

- Investors with specialized knowledge in assets beyond the stock market, such as real estate, private businesses, or precious metals can benefit from a Self-Directed IRA (SDIRA).

- Self-Directed IRA investors can hedge against the volatile stock market by investing in alternative assets that generally provide a steadier, more reliable revenue stream.

- A Self-Directed IRA is an ideal retirement account for individuals who thrive on freedom, power, and flexibility.

- Madison Trust Specialists can answer your questions about self-directed investing to help you determine if a Self-Directed IRA is right for you.

In the realm of retirement planning, individuals are constantly seeking ways to gain control of their retirement savings and investments. One powerful tool of increasing popularity is a Self-Directed IRA (SDIRA). Unlike standard IRAs, Self-Directed IRAs give investors the freedom to choose exciting alternative investment options beyond stocks, bonds, and mutual funds. Before opening an account, consider if this increased flexibility and control is for you.

With Valentine’s Day near, let’s explore - Roses are Red, violets are blue, is a Self-Directed IRA right for you?

If Stocks and Bonds Feel like Déjà Vu

One of the main benefits of a Self-Directed IRA (SDIRA) is that you can diversify your retirement portfolio with alternative investments. With an SDIRA, you can invest your retirement funds into assets like real estate, private equity, precious metals, and promissory notes. Typically, standard IRAs at brokerage houses only offer limited investment options on the stock market (stocks, bonds, and mutual funds). So, if you are looking for a tax-advantaged way to build a diversified retirement portfolio, a Self-Directed IRA may be worth considering.

If You’re Passionate about Assets like Real Estate, Alternative Investments Could be Your Cue

Self-Directed IRAs are advantageous for investors with specialized knowledge in a niche market, such as real estate investing. Investors often come to Madison Trust with an alternative investment in mind that they have expertise in and believe in.

Some unique investments include a vineyard, farmland, Airbnb, creative projects like television production or music royalties, and real estate syndications. You can align your retirement savings with your passion and expertise, potentially turbocharging your retirement nest egg.

If You Wish to Support Entrepreneurs, Dreamers, and Private Business Owners Too

Other popular investments with a Self-Directed IRA are private placements and crowdfunding and startup ventures. For example, you can invest in a variety of private companies such as a local restaurant, healthcare startup, new technology company, movie venture, or another small business. You can grow your retirement savings, while supporting your local community and economy.

If You Seek Stability and Tax Advantages, use an SDIRA to Watch Your Wealth Accrue

Self-Directed IRAs allow investors to hedge against stock market fluctuations. They achieve this by investing in alternative assets that typically provide a steadier, more reliable revenue stream. For example, rental properties generally bring in a steady stream of rental income each month you have a tenant.

Additionally, throughout history, alternative investments like real estate and precious metals are generally inversely correlated with stock market products. By adding these alternative assets to your retirement portfolio, you can typically hedge against inflation and economic fluctuations.

Plus, when you invest with an SDIRA, your funds can grow tax-free (Self-Directed Roth IRA) or tax-deferred (Self-Directed Traditional IRA), depending upon your account type.

If You’re Risk-Tolerant, Looking to Navigate the Market’s Fluctuations, and Have a Strategy That’s True

Like any investing strategy, self-directed investing involves potential risk. When you invest in publicly-traded products, your return generally depends on the selection and timing of your investment. On the other hand, when you invest in an alternative investment like a rental property you have control over things like rental costs, property improvements, and management expenses. This allows you to receive potentially more stable returns.

Although some investments are generally considered safer, savvy investors recognize that greater risks can lead to substantial returns. It is considered best practice to conduct due diligence and speak with a financial advisor to determine if alternative investing is right for you.

Investors comfortable with taking calculated risks and weathering market fluctuations are typically better suited for self-directed investing. For more information regarding the risk associated with Self-Directed IRAs, visit Self-Directed IRA Investor Alert Response.

If You’re a Do-It-Yourselfer Investor, a Self-Directed IRA may be the Avenue

Another well-liked benefit of Self-Directed IRAs is the investment freedom of the account. You can essentially invest in almost any IRS-approved asset, excluding collectibles, life insurance, and S-corporation stock.

Self-Directed IRA custodians must comply with IRS rules. They cannot sell investment products, give investment advice, evaluate an investment’s legitimacy, or verify the accuracy of an investment’s financial information. The Self-Directed IRA account holder is responsible for conducting due diligence before making any investment decisions. They should understand their investments and Self-Directed IRA rules, including prohibited transactions.

This task does not deter most self-directed investors since they are do-it-yourselfers. A Self-Directed IRA is ideal for individuals who thrive on the freedom, power, and flexibility this retirement account offers.

Roses are Red, Violets are Blue, could a Self-Directed IRA Be Your Breakthrough?

Are you interested in joining the ranks of thousands of clients who are diversifying their portfolios and growing their retirement savings with a Self-Directed IRA? Schedule a free discovery call with one of our Self-Directed IRA Specialists to get your questions answered and start your journey to a richer retirement today.